Credit Cards

Popular articles

All articles

UnionBank No Annual Fee: Credit Cards Without Yearly Membership Charges

Last updated

Nov 20, 2024

UnionBank Gold Visa Card: Features That Make It Great for Everyday Spending

Last updated

Nov 20, 2024

The Best UnionBank Credit Cards in the Philippines 2024

Last updated

Nov 19, 2024

Quick Guide to Activating Your Credit Card

Last updated

Oct 11, 2024

HSBC Welcome Gift: Get a Speaker or Coffee Machine with a Credit Card

Last updated

Sep 4, 2024

Metrobank Welcome Gift: Cash Credits, Coffee Machine, or Music Gadget

Last updated

Sep 3, 2024

UnionBank Credit Card Welcome Gifts for Music and Coffee Lovers

Last updated

Sep 2, 2024

HSBC Live+ Review: How Does it Compare to the Platinum Visa?

Last updated

Aug 22, 2024

18 Latest Credit Card Welcome Gifts You Shouldn’t Miss this 2024

Last updated

Jul 23, 2024

Save More: 16 Credit Cards with No or the Lowest Interest Rates

Last updated

Jul 22, 2024

How to Make Hassle-Free Tuition Payments with Your Credit Card

Last updated

Jul 19, 2024

HSBC Red Mastercard Review: 4x the Rewards, 4x the Fun

Last updated

Jul 18, 2024

17 UnionBank Credit Card Promos for New Cardholders, Travelers, More

Last updated

Jul 16, 2024

Moneymax Reviews: How Rewarding is a UnionBank Rewards Credit Card?

Last updated

Jul 11, 2024

Top 24 Easiest Credit Cards to Get in the Philippines

Last updated

Jul 10, 2024

UnionBank U Visa Platinum Credit Card Review for Card Newbies

Last updated

Jun 28, 2024

What is a Secured Credit Card and How Does It Work in the Philippines?

Last updated

Jun 27, 2024

How to Apply for a Credit Card from RCBC, Online or In-Branch

Last updated

Jun 25, 2024

For Back-to-School Expenses: 11 Best Credit Cards for Students

Last updated

Jun 21, 2024

Earn Points and Cashback: 13 Best Credit Cards for Grocery Shopping

Last updated

Jun 20, 2024

Moneymax Reviews: Is AUB Gold Mastercard the Gold Standard?

Last updated

Jun 18, 2024

What to Do With Your HSBC Rewards Points and How to Redeem Them

Last updated

Jun 11, 2024

Save Money: 33 No Annual Fee Credit Cards for 2024

Last updated

Jun 10, 2024

Security Bank Welcome Gift: Get a Free Music Gadget or Cash Credits

Last updated

Jun 6, 2024

UnionBank Platinum Visa Card vs UnionBank Platinum Mastercard Review

Last updated

May 30, 2024

24 Best Credit Cards for Low-Income Earners in the Philippines 2024

Last updated

May 29, 2024

How to Apply for a Metrobank Credit Card Online: Requirements and More

Last updated

May 28, 2024

Got a Maxed-Out Credit Card? Here's What to Do

Last updated

May 22, 2024

Maximize Your Fuel Spend: 10 Best Gas Credit Cards in the Philippines

Last updated

May 21, 2024

New to Credit Cards? Here are 16 Best Credit Cards for Beginners

Last updated

May 20, 2024

Maximize Your Card's Features: How to Use Your UnionBank Credit Card

Last updated

May 16, 2024

Swipe, Tap, and Save: 41 Credit Card Promos in the Philippines

Last updated

May 15, 2024

How to Apply for a UnionBank Credit Card in 3 Easy Steps

Last updated

May 14, 2024

Quick and Easy: How to Apply for a Credit Card Online

Last updated

May 13, 2024

17 Best Credit Cards for Shopaholics in the Philippines

Last updated

May 9, 2024

Your Travel Buddy Abroad: Top 21 International Credit Cards

Last updated

May 8, 2024

Save Big Time: 24 Metrobank Credit Card Promos for 2024

Last updated

Apr 30, 2024

16 Exclusive Perks and Promos for EastWest Credit Cardholders in 2024

Last updated

Apr 25, 2024

Get More Bang for Your Buck: 34 Best Credit Cards in the Philippines

Last updated

Apr 24, 2024

Discounts, Deals, and More: 16 PNB Credit Card Promos for 2024

Last updated

Apr 23, 2024

RCBC Credit Card Promos: 15 Best Deals in 2024

Last updated

Apr 16, 2024

UnionBank Travel Credit Cards: 7 Best Options to Bring on Trips

Last updated

Apr 12, 2024

Money Back on Your Spending? UnionBank Cash Back Visa Platinum Review

Last updated

Apr 8, 2024

Splurge and Save: 15 BPI Credit Card Promos This 2024

Last updated

Apr 4, 2024

20 Best Travel Credit Cards to Bring on Your Next Trip

Last updated

Apr 3, 2024

HSBC Credit Card Application: 4-Step Guide for First-Timers

Last updated

Mar 19, 2024

Rebates Galore: 9 Best Cashback Credit Cards in the Philippines

Last updated

Mar 18, 2024

For Essentials and Lifestyle Expenses: 14 Best Credit Cards for Women

Last updated

Mar 14, 2024

How to Avoid Credit Card Fraud in the Philippines

Last updated

Mar 12, 2024

Security Bank Credit Card Application in 5 Quick Steps

Last updated

Feb 26, 2024

Security Bank Wave Mastercard Review: Should You Ride the Hype?

Last updated

Feb 23, 2024

12 Credit Card Travel Promos this 2024 to Satisfy Your Wanderlust

Last updated

Feb 20, 2024

What is a Credit Card Annual Fee: How It Works and How to Avoid It

Last updated

Feb 14, 2024

It’s a Date! 10 Valentine’s Credit Card Promos this 2024

Last updated

Feb 13, 2024

Credit Card vs Debit Card: What's the Difference and Which to Use?

Last updated

Feb 8, 2024

Credit Card Explained: What It Is, Types, How to Use It, and More

Last updated

Jan 30, 2024

How to Earn and Redeem UnionBank Credit Card Rewards Points

Last updated

Jan 25, 2024

Get More Rewards: How to Earn Credit Card Points Quickly

Last updated

Jan 18, 2024

Heads Up, Foodies: Top 14 Credit Card Dining Promos in 2024

Last updated

Jan 17, 2024

How Do Credit Card Companies Make Money in the Philippines?

Last updated

Jan 15, 2024

Secure These Deals: 15 Security Bank Credit Card Promos for 2024

Last updated

Jan 12, 2024

Robinsons Credit Card Application in 5 Quick and Easy Steps

Last updated

Jan 11, 2024

10 Best Credit Cards for Teens: Can They Teach Good Money Habits?

Last updated

Jan 4, 2024

How to Apply for a Credit Card for the First Time in the Philippines

Last updated

Dec 22, 2023

Grab Your Gizmos: 22 Best Credit Cards for Electronics

Last updated

Dec 12, 2023

‘Tis the Season to Score Deals: Top Credit Card Christmas Promotions

Last updated

Dec 8, 2023

Moneymax Raffle 2023: Win a Samsung S23, iPhone 15, or a Trip to Japan

Last updated

Dec 1, 2023

How to Apply for an EastWest Credit Card to Start Enjoying Its Perks

Last updated

Nov 28, 2023

Promo Alert: Don’t Miss These 10 Robinsons Bank Credit Card Promos

Last updated

Nov 24, 2023

How Supplementary Credit Cards Work: What are Your Best Options?

Last updated

Nov 23, 2023

Here’s What You Can Redeem with Your Security Bank Credit Card Points

Last updated

Nov 22, 2023

How to Use Your Metrobank Credit Card's Handy Features

Last updated

Nov 21, 2023

For Your Shopping Hauls: 13 Best Credit Cards for Online Shopping

Last updated

Nov 20, 2023

Is This Rewards Card Worth It? Metrobank Titanium Mastercard® Review

Last updated

Nov 20, 2023

How to Use a Security Bank Credit Card for Different Transactions

Last updated

Nov 15, 2023

Metrobank Credit Card Rewards: How to Make Every Swipe Rewarding

Last updated

Nov 9, 2023

Don’t Miss These 12 Exclusive China Bank Credit Card Promos this 2023

Last updated

Nov 8, 2023

Can’t Decide Which Card to Get? 9 Credit Card Features to Look for

Last updated

Oct 31, 2023

Your Online Shopping Buddy: Virtual Credit Cards in the Philippines

Last updated

Oct 26, 2023

China Bank Credit Card Application: A Quick and Easy 5-Step Guide

Last updated

Oct 25, 2023

How to Get a Maybank Credit Card: An Easy Application Guide

Last updated

Oct 24, 2023

Avoid Late Payments: 9 Best Credit Cards for Rent Payment

Last updated

Oct 24, 2023

How to Report a Lost Credit Card: Steps and Important Numbers to Call

Last updated

Oct 20, 2023

What is CVV on a Credit Card and How to Keep It Safe?

Last updated

Oct 18, 2023

Moneymax Reviews: Level Up Your Game With UnionBank PlayEveryday

Last updated

Oct 16, 2023

Exclusive Offers to Enjoy: Bank of Commerce Credit Card Promos in 2023

Last updated

Oct 13, 2023

Security Bank Complete Cashback Platinum Review: Rebates and Perks

Last updated

Oct 11, 2023

AUB Platinum Mastercard Review: Is It the Right Premium Card for You?

Last updated

Oct 9, 2023

How to Request for a Credit Card Limit Increase Per Bank

Last updated

Oct 6, 2023

UnionBank Lazada Credit Card: Is It the Best Card for Online Shopping?

Last updated

Oct 5, 2023

Anatomy of Plastic Money: 13 Credit Card Parts You Should Know

Last updated

Oct 4, 2023

Moneymax Reviews: Flex Your Financial Savvy with RCBC Flex Visa

Last updated

Sep 28, 2023

10 Best Hotel Credit Cards in the Philippines for Discounted Stays

Last updated

Sep 27, 2023

Can Expats in the Philippines Get a Credit Card? Yes—Here's How

Last updated

Sep 26, 2023

Credit Card Statement 101: What is It and How to Read It?

Last updated

Sep 26, 2023

Moneymax Reviews: Earn Your Cash Back with HSBC Gold Visa Cash Back

Last updated

Sep 25, 2023

What Fees are Charged on a Credit Card? Here’s an Up-to-Date List

Last updated

Sep 22, 2023

9 Credit Card Hacks in the Philippines to Help You Save Money

Last updated

Sep 20, 2023

How to Check Your Credit Card Balance: Methods and Steps Per Bank

Last updated

Sep 19, 2023

26 Most Common Credit Card Terms Every Cardholder Should Know

Last updated

Sep 15, 2023

What is the Best HSBC Credit Card for You? Here's How to Choose

Last updated

Sep 15, 2023

Elite and Exclusive: 15 Best Black Credit Cards in the Philippines

Last updated

Sep 14, 2023

Steals and Deals: Best HSBC Credit Card Promos This 2023

Last updated

Sep 12, 2023

What is Credit Card Limit and How Do Banks Determine It?

Last updated

Sep 11, 2023

AUB Credit Card Online Application: Requirements and Steps to Follow

Last updated

Sep 8, 2023

Is It Best to Pay Your Credit Card in Full? What Happens If You Don't?

Last updated

Sep 8, 2023

Cashback vs Rewards Credit Card: How to Choose the Better Option

Last updated

Sep 7, 2023

What are the Requirements for Getting a Credit Card in the Philippines?

Last updated

Sep 5, 2023

What is the Minimum Amount Due on a Credit Card and How is It Calculated?

Last updated

Sep 5, 2023

Best Credit Cards for PAL Mabuhay Miles, Cebu Pacific GetGo Points, and airasia points

Last updated

Sep 2, 2023

Is HSBC Platinum Visa Rebate the Best Travel and Shopping Credit Card?

Last updated

Aug 30, 2023

4 Security Bank Credit Card Installment Plans for Hassle-Free Payments

Last updated

Aug 30, 2023

PNB Ze-Lo Credit Card Review: Is It the Best Card for Starters?

Last updated

Aug 30, 2023

Can I Get a Credit Card Without Income Proof? 6 Alternatives for You

Last updated

Aug 29, 2023

How to Choose a Credit Card Based on Your Needs and Lifestyle

Last updated

Aug 29, 2023

Enjoy Instant Travel Savings with These Klook Credit Card Promos

Last updated

Aug 29, 2023

Bank of Commerce Credit Card Application: How to Do It Online or Offline

Last updated

Aug 25, 2023

For Essential and Lifestyle Expenses: 12 Best Credit Cards for Families

Last updated

Aug 25, 2023

How to Apply for a PNB Credit Card Online or In-Person

Last updated

Aug 24, 2023

Difference Between Visa and Mastercard: Is One Better Than the Other?

Last updated

Aug 22, 2023

BPI Credit Card Application: Requirements, Process, and More

Last updated

Aug 22, 2023

14 Best Credit Cards for Dining: Make Food Trips Worth It

Last updated

Aug 18, 2023

Moneymax Reviews: Comparing AUB’s Budget-Tier Credit Cards

Last updated

Aug 16, 2023

How Much are the Credit Card Interest Rates in the Philippines?

Last updated

Aug 16, 2023

Credit Card Battle: Security Bank Platinum vs World Mastercard Review

Last updated

Aug 14, 2023

UnionBank Credit Card Annual Fee, Interest Rate, and Other Fees to Remember

Last updated

Aug 11, 2023

Metrobank World vs Platinum Mastercard®: Which is Better for You?

Last updated

Aug 10, 2023

Time to Reap the Rewards: How to Use Your Credit Card Points

Last updated

Aug 9, 2023

Is a Balance Transfer Credit Card a Good Idea? Here's How It Works

Last updated

Aug 4, 2023

Moneymax Reviews: Go for Gold with a Security Bank Gold Mastercard

Last updated

Aug 2, 2023

Why Get Another Card: Is Having Multiple Credit Cards Good or Bad?

Last updated

Jul 26, 2023

How to Pay Bills Using a Credit Card in the Philippines for Beginners

Last updated

Jul 25, 2023

Dual Currency Credit Cards: Pros and Cons for Frequent Travelers

Last updated

Jul 24, 2023

How Does a Credit Card Installment Plan Work in the Philippines?

Last updated

Jul 19, 2023

Grow Your Venture in 2023: 10 Best Credit Cards for Business

Last updated

Jul 19, 2023

7 Tipid Tips for Using Your Credit Card Abroad

Last updated

Jul 17, 2023

Swipe for Emergency: Credit Card for Hospital Bills in the Philippines

Last updated

Jul 17, 2023

Best Credit Cards for Millennials and Gen Zs in 2023

Last updated

Jul 10, 2023

BPI Credit Card Comparison Review: Which One is Right for You?

Last updated

Jun 19, 2023

Deals Galore: Top Maybank Credit Card Promos You Shouldn’t Miss

Last updated

May 31, 2023

Do More with Your Card: Top AUB Credit Card Promos This 2023

Last updated

May 30, 2023

Improve Your Chances of a BPI Credit Card Approval with These Tips

Last updated

May 24, 2023

Top 11 BPI Credit Card Perks: Why You Should Make the Switch Today

Last updated

May 8, 2023

Fly for Free When You Convert Your Credit Card Points to Miles

Last updated

May 4, 2023

Save Big on Your Travels With These Agoda Credit Card Promos

Last updated

Apr 27, 2023

Say Goodbye to Late Payments with These Credit Card Payment Methods

Last updated

Apr 25, 2023

The Online Shopper’s Best Friend: What is the BPI eCredit Card?

Last updated

Mar 20, 2023

How to Deal with a Declined Credit Card Application in the Philippines

Last updated

Mar 16, 2023

Take Back Control: Credit Card Amnesty Program in the Philippines

Last updated

Mar 14, 2023

No Overspending and Late Payments: How to Manage Multiple Credit Cards

Last updated

Feb 21, 2023

Cash vs. Credit Card: Should You Go Cashless?

Last updated

Oct 24, 2022

Maximize Your Spending with These Co-Branded Credit Cards

Last updated

Jun 23, 2022

10 Advantages of Credit Cards for People Who Are Afraid to Get One

Last updated

Jun 9, 2022

Credit Card Dos and Don’ts: What Should You Do and Not Do with Your Card?

Last updated

May 17, 2022

There’s a New Card in Town: Why and How to Get a Robinsons Bank Pru Life Credit Card

Last updated

Apr 18, 2022

Top Tips for Freelancers in the Philippines Who Want a Credit Card

Last updated

Mar 23, 2022

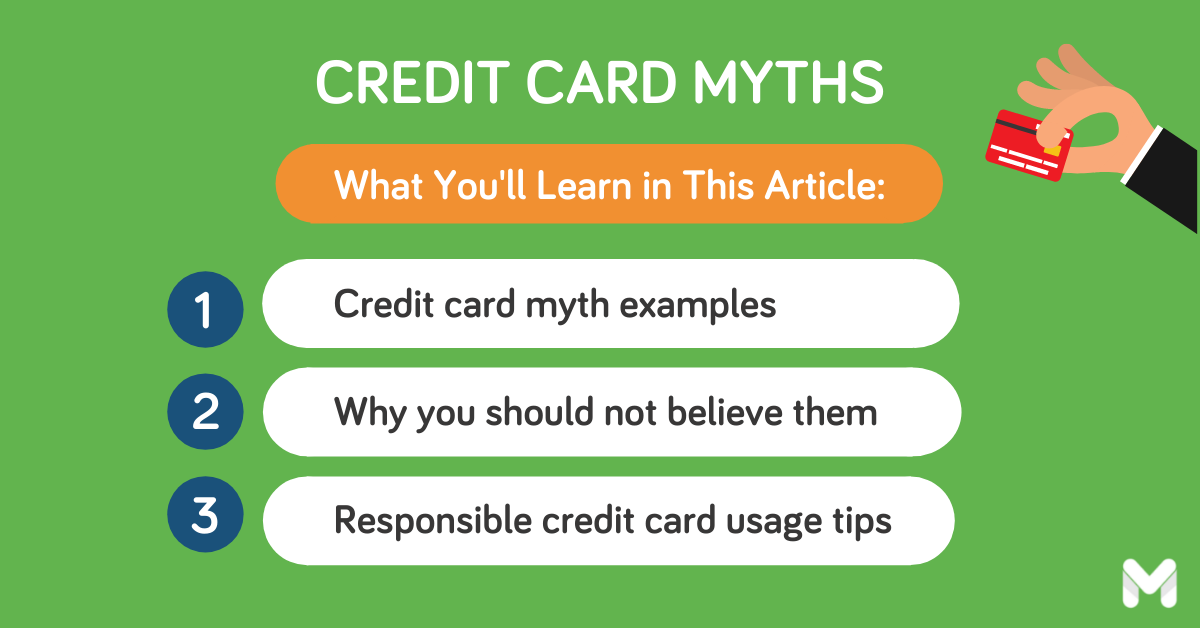

10 Credit Card Myths You Should Stop Believing

Last updated

Mar 23, 2022

3 Cautionary Tales of Irresponsible Credit Card Use

Last updated

Jan 12, 2022

Getting Calls from Credit Card Agents? Remember These Dos and Don’ts

Last updated

Jan 12, 2022

Get a Credit Card 100% Online with Moneymax and UnionBank

Last updated

Dec 24, 2021

Should I Get a Credit Card? Helpful Tips to Know When to Get One

Last updated

Sep 6, 2021

How Risky is a Credit Card Cash Advance in the Philippines?

Last updated

Jul 23, 2021

OUR MISSION

We help you lead a healthier financial life.

_1200x628.png)

_1200x628.png)

_1200x628.png)

_1200x628.png)

_1200x628.png)

.png)

.png)

-1.png)