Running your own business is hard enough as it is. What more with an additional challenge thrown your way, such as a pandemic?

Ask successful entrepreneurs in the Philippines to share their stories, and they'd say that navigating challenges builds a solid foundation. Amidst the lockdowns and restrictions years ago, local entrepreneurs had to learn how to operate a business in a limited capacity—but they became stronger and better because of it.

The pandemic seems to be a thing of the past, with MSMEs well on their way to recovering this 2023,[1] but there's still a lot that new or aspiring business owners can learn from successful Filipino entrepreneurs who weathered the storm.

6 Successful Entrepreneurs in the Philippines and Their Stories

Dreaming of starting a business in the Philippines? You can do it with plenty of hard work and a whole lot of luck.

Here are some inspiring success stories of Filipino entrepreneurs who started small.

👉 Luilyn Abapo, Owner of Lulu Blue Cakes

Baking had always been a passion for Luilyn Abapo, the woman behind Lulu Blue Cakes. She loved her job as an HR practitioner but saw the kitchen as her refuge. She thus started her small business as a passion project and a therapeutic activity.

“With the opportunity to work from home during the pandemic, my sisters urged me to make it an official business and offer our goodies to the general public. Baking on weekends became our bonding,” Luilyn shared.

With families who enjoy sweet treats as her target customers, Luilyn began with blueberry cheesecake cups, which became an instant hit with her family and friends. Buoyed by her love for baking and the support of her loved ones, she began experimenting with new recipes and eventually started selling banana loaf and triple chocolate brownies.

Operating During a Pandemic

When the pandemic hit, one of the biggest challenges Luilyn faced was transporting her products to customers. “The cakes, especially the cheesecakes, are delicate. Sometimes, when they get to the customer, they’re no longer in their best state.”

To address this problem, she tried different packaging options and thought of smart ways to ensure the cheesecakes survived the transit. She also reminded delivery riders to handle the packages with care.

Providing Incentives for Riders

Because of the delivery issues, Lulu Blue Cakes came up with an incentive program—free 1 kilo of rice for every rider who picked up an order—to show appreciation for riders who go the extra mile to deliver the cakes in a perfect state.

"The riders are among the heroes of the pandemic and they help our small business thrive. So we thought that if they help us provide food on the tables of our clients, we can give back by ensuring that the riders and their families have food on their table, too."

Proud Moments

A successful business, no matter how small, is a big deal. “I’m proud of how a small business like Lulu Blue can make a difference to the community by helping riders even with just a kilo of rice,” she shared.

The hours were long, tiring, and hectic, but there were also lots of rewards. “The most rewarding aspect of running the business is being acknowledged by the clients, receiving good feedback, and being featured by food bloggers and food critics. These signify that we’re doing a good job, and that Lulu Blue became part of their best moments.”

Knowing Your Value

Though Lulu Blue Cakes is no longer operational as of November 2022, hers is still an inspiring story.[2] As a business owner, Luilyn also learned a lot.

“The biggest financial lesson I learned is to know the value of your products, including the cost of doing it. Don’t be afraid to put a premium on something that’s really good and worth it. When clients know the quality you put into what you sell, they won’t hesitate to pay. Your product will speak for itself,” Luilyn said.

👉 Leslie Rabinovich, Owner of Esencia Day Spa

Before she became a successful entrepreneur, Les Rabinovich worked as a flight attendant in a major airline company for many years. She always looked forward to a full pampering treatment after every long-haul flight because she found massage therapies relaxing and beneficial.

When Les decided to put up Esencia Day Spa,[3] she had busy working parents and young professionals in mind. “We Filipinos are naturally nurturing and empathetic. I want to highlight this in the service that we provide in our spas. When I opened Esencia, I wanted it to be an extension of that enactment of service,” she added.

Esencia Day Spa is a boutique spa offering hotel-quality spa service and treatments with a personal touch. Les opened her first branch in Nuvali, Santa Rosa, Laguna in November 2015. Then she launched another branch in Forbestown at The Fort, Taguig in December 2017.

Even with its luxurious services, Esencia maintains its affordability and its organic, sophisticated, and holistic experience for its guests.

The Business of Caring

The wellness industry was one of the hardest-hit industries during the pandemic. Every time there was a new community quarantine announcement, wellness spas were among the first to close and the last to open.

“Spas are all about personal service and human touch, so it was really a challenge for us when we closed for eight months, especially for my staff. ”

Still, Les was very thankful to have such a loyal and well-trained team. She made sure they were all taken care of during the lockdown. “We offered help to our staff financially and opened our own home to some of them where they can stay and provide home massage services in our area—while following strict safety protocols, of course. With this, I can truly say that we're in the business of caring.”

Rewarding Aspects

When Les reopened Esencia, she noticed an immense transformation in her clients. Loneliness, isolation, and anxiety levels were at an all-time high. More than ever, they wanted to reward themselves after overcoming their own struggles.

“For me, the most rewarding aspect of operating this business is that our clients consider a spa treatment at Esencia a reward for themselves. They miss our place and their favorite therapists giving them a pampering session,” Les shared.

After all, therapeutic touch in reflexology, as well as shoulder, head, and body massages, are just some of the most effective ways to alleviate depression, stress, and anxiety.

Learning to Adapt

For Les, all business owners should learn to quickly adapt, no matter the situation. The pandemic was an extreme event that forced everyone to be tougher, more resilient, and more creative. “You need a game plan to get your business through not just for the next few days but also for the foreseeable future.”

See also: From Business to the Arts: Empowered Women in the Philippines

👉 Mariel Bitanga, Founder of Simply Finance

Mariel is the founder of Simply Finance,[4] a boutique financial planning firm that provides financial solutions to Filipinas. Young professionals and newly married couples also approach Mariel for financial advice.

“I learn their money stories, their current situation, their money beliefs, and what they want to achieve. From this information, I help create a plan for them, complete with actionable steps,” Mariel said.

Like how a fitness coach or nutritionist creates a meal plan, Mariel creates a budgeting or investing plan for her clients that will help them achieve their financial goals.

Blessing in Disguise

When the pandemic hit, Mariel couldn’t conduct face-to-face workshops and seminars with her clients anymore. She had to move all her meetings and sessions online.

But it turned out that going digital had more advantages than disadvantages. “Going digital opened up more partnerships for me. I was able to reach more clients that I wouldn't have reached in normal circumstances.”

However, there was also a lack of connection. “Sometimes, clients will book a call, but they’re not that committed. Sometimes they just don’t show up for the call at all.”

Building Lasting Relationships

The biggest payoff is building genuine relationships with her clients over the years. They may start out as clients, but they often end up being good friends as well.

According to Mariel, clients usually refer her to their friends and relatives. Pretty soon, almost everyone in the family or friend circle is her client, too. For her, it's rewarding to know that she’s able to help not just one client but their loved ones as well.

She also loves receiving messages from clients thanking her for her help or just updating her on their lives. “I’m really just thankful for their trust.”

Mariel remains motivated to help people plan for their future and put their money in the right place. “I’ll continue what I’m doing now. I’ll keep working to attract new partners and clients.”

Related: Why and How I Went from Freelance to Full-Time Work

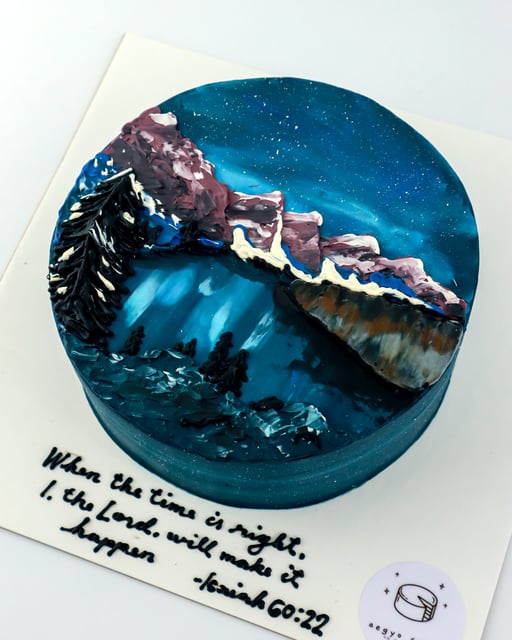

👉 Karren Seña, Kihyan Chua Yap, and Koleen Chua Yap, Co-Owners of Aegyo Cakes

.png?width=600&height=600&name=Quote%20Card%20(2).png)

Business runs in their blood! Before siblings Karren, Kihyan, and Koleen started the widely successful Aegyo Cakes,[5] they were all helping their mom run the family's office uniform manufacturing business. When the pandemic happened, they had to pause their business operations and pivot to producing face masks and PPEs for medical frontliners.

But for this artistic bunch, staying at home for several months and sewing face masks by hand was tough.

One night, while sewing masks, Koleen asked Kihyan what kind of business she wanted to do. Kihyan thought of food. They both loved watching baking and cooking shows on Netflix, so they thought it was something they could venture into.

When they found themselves unable to celebrate a relative's birthday due to restrictions, they sent them a cake instead. They thought they could offer the service to other families as well.

“Hindi kami makapag-celebrate as a family, what more 'yung ibang mga tao? We wanted to give other people a way to celebrate with their loved ones even if they can’t be there. Dun nabuo 'yung concept ng Aegyo Cakes: 'Send love with Aegyo Cakes,'” Karren said.

On a Hallyu High

It’s surprising, but the siblings behind Aegyo Cakes are not professional bakers. When they were starting out the business, they had to learn everything on their own by trying a lot of recipes. There was definitely a lot of trial and error.

But they knew their target customers. Everyone in the family loved K-culture―from K-drama to K-pop. And they knew there were legions of Pinoys who loved Korean pop culture as well.

Their timing couldn’t have been more perfect. Their small online cake business rode the first wave of Korean minimalist trends in the country. “It may have started from a trend, but it very quickly became more than that,” Karren said.

Biggest Struggles

Starting a business in the middle of a pandemic was truly challenging. It was more difficult to look for suppliers or go on supply runs. They also couldn’t hire people even if there was a sudden increase in demand.

Their priority was everyone’s safety. Before they expanded their operations, the family made sure they could protect and keep each other safe.

With a lot of careful planning, Aegyo Cakes moved out of their home kitchen to a new one and hired more staff. They also built their own website to accommodate orders.

Finding Purpose

With more than 100,000 followers on Instagram, the siblings truly feel the love people have for Aegyo Cakes. But more than the numbers, it’s the fact that people choose Aegyo Cakes to send love to their loved ones.

“What gives our cakes more purpose and more meaning are the stories behind them. Every time they buy cakes from us, every time they send love with Aegyo Cakes, they really make our kitchen the happiest place on earth. Nakakapag-contribute kami sa pag-ikot ng pagmamahal sa Metro Manila.”

Just Go Ahead and Do It

These local entrepreneurs' success story is all thanks to their mother, the master negosyante. Whenever they had a business idea, their mother would tell them to just go ahead and do it.

“Yes, you have to plan. Yes, you have to think about it. But you really just have to jump out there and learn along the way.”

There are no limits to what you can do. Even if you’re pushed back into a corner, use that to think of other ways you can earn money. For the sisters, there are lots of ways to earn, especially if your purpose is to serve and give value to other people.

“Your business should be something that you love,” the siblings added. “It has to have a purpose bigger than us so that we'll keep going even when times are difficult.”

Reinvesting in the Business

“If the business starts earning, put money back into the business,” they advised. This is what the sisters did when Aegyo Cakes hit their first ₱1 million in just their third month (or 100th day, which happens to be a special milestone in Korean culture). They didn’t splurge but decided to put it back in the business.

“Our business growth may be considered exponential, but we really put a lot of thought into it. We’ll just keep sending more love, and we're in it for the long term.”

Related reading:

- Lessons from Women in Leadership: On Empathy, Inspiration, and More

- The Richest Women in the Philippines (and Their Sources of Wealth)

Final Thoughts

These successful entrepreneurs in the Philippines and their stories prove that anyone can overcome challenges with grit and grace. Let them inspire you to hustle harder so you can put up your own business, too. For those going through tough times, keep learning and adapting to change!

If you're cash-strapped, don't be disheartened. You can still start a business like these successful Pinoy entrepreneurs did.

To jumpstart your business, consider applying for a personal loan. Compare your options and apply through Moneymax:

|

Provider

|

Loan Amount

|

Monthly Add-on Rate

|

Loan Term

|

Minimum Annual Income

|

Approval Time

|

|---|---|---|---|---|---|

|

UnionBank Personal Loan

|

Up to ₱2 million

|

26.9% per annum

|

12 to 60 months

|

₱250,000

|

As fast as 5 minutes

|

|

UNO Digital Bank Personal Loan

.png?width=149&height=52&name=Unobank-Logo-Colored_Horizontal-Medium%20(for%20MMX).png) |

₱10,000 to ₱500,000

|

1.79% per month (corresponds to annual contractual rates or annual percentage rates ranging from 35.78% to 37.54%)

|

Six to 36 months

|

₱240,000

|

Five to seven banking days

|

|

Metrobank Personal Loan

|

₱20,000 to ₱2 million

|

1.25% to 1.75%

|

36 months

|

₱350,000

|

Seven banking days

|

|

BPI Personal Loan

|

₱20,000 to ₱3 million

|

Maximum annual contractual rate of 28.67%

|

12 to 36 months

|

Inquire with BPI

|

Five to seven banking days

|

|

Tonik Credit Builder

|

₱5,000 to ₱20,000

|

4.84%

|

Six to 12 months

|

Inquire with Tonik

|

Two banking days

|

|

Tala

|

₱1,000 to ₱25,000

|

0.43% daily

|

Up to 61 days

|

None

|

Five minutes to 24 hours

|

|

HSBC Personal Loan

|

₱30,000 to ₱500,000

|

0.65%

|

Six to 36 months

|

₱168,000

|

Five to seven banking days

|

|

CIMB Personal Loan

|

₱30,000 to ₱1 million

|

As low as 0.83%

|

12 to 60 months

|

₱180,000

|

One to two banking days

|

|

Maybank Personal Loan

|

Up to ₱1 million

|

1.3%

|

Up to 36 months

|

₱300,000

|

Inquire with Maybank

|

|

RCBC Bank Personal Loan

|

₱50,000 to ₱1 million

|

1.3%

|

Six to 36 months

|

₱360,000

|

5 to 7 banking days

|

|

PSBank Personal Loan

|

₱20,000 to ₱250,000

|

|

24 or 36 months

|

₱180,000

|

Five to nine banking days

|

Sources:

- [1] MSMEs to lead Philippines post-COVID-19 economic recovery (Philstar, 2023)

- [2] Lulu Blue Cakes on Facebook

- [3] Esencia Day Spa

- [4] Simply Finance

- [5] Aegyo Cakes