Owning a home is a milestone that anyone will be proud of. For some, it’s a sign of financial independence. For others, it’s a status symbol.

Despite the financial challenges due to the pandemic in the past few years, more Filipinos sought opportunities to own a house last year, which resulted in the Pag-IBIG Fund releasing a record-high ₱57.07 billion worth of home loans in the first half of 2023.[1]

With low interest rates and longer repayment terms, the Pag-IBIG Housing Loan is one of the more affordable and flexible home financing schemes in the Philippines. If you’re planning to apply for this home loan, we’ve come up with a simple primer that covers the program’s basics. We also have Pag-IBIG housing loan tips to increase your chances of getting approved.

What is a Pag-IBIG Housing Loan?

Launched in 1978, the Home Development Mutual Fund, or the Pag-IBIG Fund, is a government-owned agency that manages the national savings program and offers affordable house financing to its members. With a repayment term of up to 30 years, this works as a more flexible alternative to bank and in-house home financing schemes.

You can borrow up to ₱6 million for any of the following purposes:

- Residential lot purchase (including the cost of transfer of title)

- Resdential house and lot, townhouse, or condo unit purchase (including the cost of transfer of title)

- Home construction or improvement

- Home loan refinancing

- Combined loan purposes

🏡 Give Your Home a Makeover With UnionBank Personal Loan!

Need extra funds for your home improvement? You don't have to delay it if you're short on cash. Get a loan from UnionBank via Moneymax! Enjoy a fast application and approval process, plus instant loan disbursement! Borrow up to ₱2 million and have your loan disbursed in as fast as 24 hours!

👉 What is a Pag-IBIG Affordable Housing Loan?

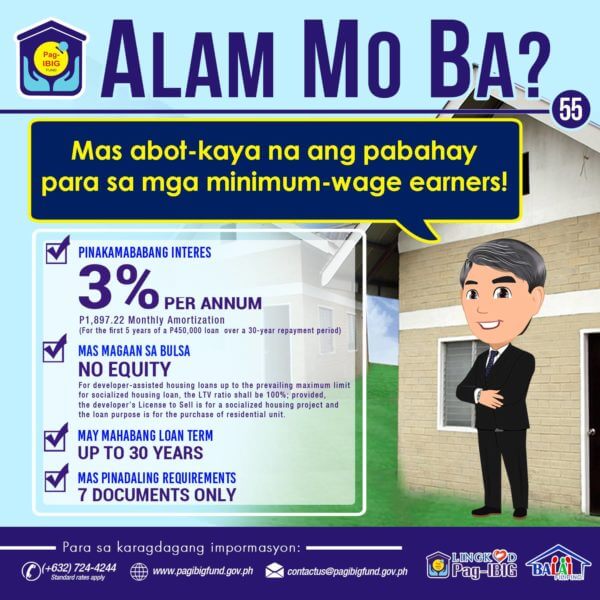

It’s important to note that Pag-IBIG has a separate housing loan program for minimum-wage and low-income earners, aptly called the Pag-IBIG Affordable Housing Loan Program.

Under this program, members who earn up to ₱15,000 a month within the National Capital Region (NCR) or ₱12,000 outside the NCR can apply for a housing loan. Pag-IBIG offers a subsidized interest rate for home loans up to ₱580,000 in socialized subdivision projects and special low rates for loans up to ₱750,000 in socialized condominium projects.[2]

What are the Interest Rates of the Pag-IBIG Housing Loan?

The Pag-IBIG Housing Loan interest rates are some of the lowest on the market today. Your rate will depend on your preferred repricing period.

Here are Pag-IBIG’s interest rates as of July 2023:[3]

| Repricing Period | Interest Rate |

| 1-year fixing | 5.75% |

| 3-year fixing | 6.25% |

| 5-year fixing | 6.5% |

| 10-year fixing | 7.125% |

| 15-year fixing | 7.75% |

| 20-year fixing | 8.50% |

| 25-year fixing | 9.125% |

| 30-year fixing | 9.75% |

What is a repricing period, you ask? The repricing period refers to the period where the indicated interest rate takes effect. After the said period, your interest rate will change. It will either go up or down, depending on the economy at the time of the repricing.

Say you go for a loan with a repricing period of three years. Looking at the table above, this means that you will pay a Pag-IBIG Housing Loan interest rate of 6.25% for three years. After three years, Pag-IBIG will conduct an evaluation and change the interest rate depending on the prevailing market conditions.

👉 What are the Interest Rates for the Pag-IBIG Affordable Housing Loan?

On the other hand, the Pag-IBIG Affordable Housing Loan entitles qualified members to special subsidized interest rates. Borrowers can enjoy an interest rate of 3% for the first five years of the loan term and a 6.5% interest rate during the first 10 years of the loan.

What are the Pag-IBIG Housing Loan Repayment Terms?

You can pay for your loan for up to 30 years. However, the payment period should not exceed the difference between the age of 70 and your current age.

How to Apply for a Housing Loan in Pag-IBIG

The Pag-IBIG housing loan application process isn’t easy, though—and neither is getting approved. It will take time, energy, and even money to comply with all the eligibility and documentary requirements.

Here’s everything you need to know:

👉 Pag-IBIG Housing Loan Eligibility

You are eligible for a Pag-IBIG Housing Loan if you satisfy the following:

- You must have remittances of monthly contributions for at least 24 months.

- You must not be more than 65 years old at the date of application.

- You must not be more than 70 years old at the maturity of the loan.

- You must be of legal capacity to encumber real property.

- You must have the ability to pass a background check, which includes an inspection of credit, employment, or business.

- You must not have an outstanding Pag-IBIG Short-Term Loan (STL) in arrears.

- You must not have a Pag-IBIG Housing Loan that was cancelled, foreclosed, or bought back due to a default.

- Your account must be updated if you have an existing Pag-IBIG Housing Loan as a principal buyer/borrower or co-buyer/co-borrower.

👉 Pag-IBIG Housing Loan Requirements

Here are the Pag-IBIG Housing Loan requirements for 2024:

- Pag-IBIG Housing Loan application form with recent ID photo of borrower/co-borrower (if applicable)

- Proof of income

- For locally employed - Any of the following: Certificate of Employment with your gross monthly income, monthly allowances, and monthly monetary benefits; Latest Income Tax Return (ITR); one-month payslip for the last three months before the date of the application

- For self-employed - Any of the following: ITR, audited financial statements, official receipt of tax payment from the bank, commission vouchers, bank statements or passbook for the last 12 months (for income sourced from pensions, foreign remittances, etc.), copy of Lease Contract and Tax Declaration, Certified True Copy of Transport Franchise issued by the concerned government agency, Certificate of Engagement, other documents proving your source of income

- For Overseas Filipino Workers (OFW) - Employment contract, notarized Certificate of Employment and Compensation

- One valid ID (back-to-back photocopy) of principal borrower and spouse, co-borrower and spouse, seller and spouse, and developer’s authorized representative (if applicable)

- Transfer Certificate of Title (latest and certified true copy)

- For condominiums: TCT of the land and Condominium Certificate of Title (certified true copy)

- Updated tax declaration

- Updated real estate tax receipt (photocopy)

- Contract to-Sell or similar agreement between buyer and seller

- Vicinity map/sketch of the property

- Health statement for borrowers over 60 years old and members availing of ₱2 million to ₱6 million housing loans

For the complete list of requirements per loan purpose, visit the Pag-IBIG website.[4]

👉 Pag-IBIG Housing Loan Application Steps

How to apply for a Pag-IBIG Housing Loan? Follow these six steps:

- Step 1 – Gather all your documentary requirements. Make sure details are accurate and up to date.

- Step 2 – Submit your Pag-IBIG Housing Loan application. You can do so via the accredited partner-developer from whom you plan to buy your property. If not, you can head to any Pag-IBIG Housing Business Center or Pag-IBIG Fund branch. You can also start your application via Virtual Pag-IBIG.

- Step 3 – Wait for your Notice of Approval (NOA) and Letter of Guaranty (LOG). Pag-IBIG will advise you where to claim these documents.

- Step 4 – Complete the requirements enumerated in your NOA within 90 calendar days.

- Step 5 – Get your Pag-IBIG Housing Loan proceeds. After submitting your post-approval documents, you’ll receive the proceeds within 10 working days.

- Step 6 – Start paying your housing loan exactly one month after the loan’s release date.

How Long Does the Pag-IBIG Housing Loan Processing Take?

.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(38).png)

According to Pag-IBIG Citizens Charter 2023,[5] the Pag-IBIG Housing Loan approval time is around 20 working days.

After you submit your complete documents, the Pag-IBIG Housing Loan takes around 17 processing days.

Wondering how many days it takes for the Pag-IBIG Housing Loan release? If they approve your housing loan, they will release the proceeds three days after you submit the required post-approval documents.

Pag-IBIG Housing Loan Tips: How to Raise Your Chance of Approval

Here's how to increase your chances of getting approved for a Pag-IBIG housing loan.

✔️ Settle Any Overdue Pag-IBIG Loan Payment

Any missed payment can ruin your chance of getting approved for a new loan. Pag-IBIG declines housing loan applications from borrowers with unpaid multi-purpose loans or foreclosed/canceled housing loan accounts with the agency. Check your existing Pag-IBIG loan accounts, if any, and pay off any outstanding loans before you apply for a new housing loan with Pag-IBIG.

✔️ Keep a Stable Source of Income

Thinking of quitting your job? Job hopping will hurt your chances of getting approved—more so if you switch to a lower-paying job or a career with irregular income.

Pag-IBIG will check your employment history to assess if you’re financially stable enough to handle all your monthly mortgages. Your employment tenure proves your income stability.

Ideally, you should have a steady income source for at least two years. You’re better off sticking with your current job if you plan to apply for a loan with Pag-IBIG soon.

✔️ Check Your Credit Report and Improve Your Credit Score

Think of the credit score as a representation of your trustworthiness and responsibility when handling loans and other financial obligations. Any delinquency in your credit card and loan payments is a red flag to lenders. If you have a bad track record of repayments, you’re less likely to get approved

Review your credit report at least a year before applying for a housing loan with the Pag-IBIG Fund. This will give you enough time to correct any errors and improve your credit score. You can access your credit report through the Credit Information Corporation[6] or one of its accredited credit bureaus.

✔️ Apply for an Amount You Can Actually Pay Back

Qualified Pag-IBIG members can borrow up to ₱6 million for financing a home, but that doesn’t mean you should go for the maximum amount. After all, the agency will still evaluate if you’re actually qualified. The same level of verification and evaluation will also apply even if you’re borrowing money worth less than ₱6 million.

Consider your financial situation and capacity. Can you pay the principal and interest with your monthly income?

Pag-IBIG has a housing loan affordability calculator[7] that quickly computes how much you can borrow and pay in monthly amortization. The calculation is based on your income, your chosen loan term and fixed pricing period, and the estimated value of the property you want to buy. It's also useful if you want to know the required gross monthly income for the amount you want to borrow.

✔️ Make a Higher Down Payment

Making a huge down payment proves your financial stability. It’s also a win for you since you’ll be borrowing a lower amount from the Pag-IBIG Fund, which in turn may mean lower monthly amortizations.

Ideally, pay at least 20% of the property’s value. If you can pay more, better.

If you’re determined to raise a higher down payment and willing to delay your purchase, consider creating another stream of income, such as side gigs or a small business. If you have a windfall, such as an unexpected inheritance, commission, or bonus, use it to fund your down payment.

✔️ Ensure Your Income Document Reflects All Your Earnings

Your Certificate of Employment and Compensation (CEC) can make or break your housing loan application. This income document, which shows your gross monthly income and other monetary benefits, proves your capacity to repay your loan.

Your CEC must contain accurate and updated information. For instance, if you recently got a raise, it should indicate your latest monthly salary. If you’re receiving de minimis benefits or non-taxable allowances, request your HR manager to include such details as well.

✔️ Consider Applying for the Affordable Housing Loan Program

If your income is low, it’s hard to qualify for most home loans in the Philippines. But fortunately, you may qualify for Pag-IBIG’s Affordable Housing Loan Program.

As mentioned earlier, this program offers subsidized interest rates and special low rates. If your application is approved, your monthly payments might be more manageable.

✔️ Make a Checklist of the Requirements to Submit

To keep track of which documents you’ve already secured and those you still need to work on, create a checklist of all housing loan requirements and their corresponding status on a spreadsheet.

Double-check the accuracy of the information in your documents to avoid delays. Also, compile your documents in one folder or envelope to ensure everything’s in place when you submit the housing loan requirements to Pag-IBIG.

✔️ Bid Wisely on Properties Under Negotiated Sale

Borrowers who want to purchase properties under negotiated sale[8] are required to make a bid by submitting an Offer to Purchase in a sealed envelope. The borrower with the highest bid gets the chance to purchase the property. Pag-IBIG provides a list of homes under this category with a specified bidding period.

Making a bid can be very exciting, but this should be done with much thought. Visit the showcased property first—most of the houses under negotiated sale are fully constructed but either abandoned or in need of renovation.

Here are a few things to remember before making the offer:

- Properties are sold on an “as is, where is” basis, which means you accept the current physical condition of the property.

- Offers should not fall below the property market value set by Pag-IBIG.

Homes under negotiated sale can also be purchased with a discount depending on your chosen mode of payment which you’ll also indicate when bidding.

- 30% discount for cash purchases payable within 30 days

- 20% discount for short-term availment payable in equal monthly installments for 12 months

- 10% discount for long-term availment

Read more: How to Get Approved for a Housing Loan: 10 Tips for Home Buyers

What to Do Next if Your Pag-IBIG Housing Loan Application Gets Rejected

It can be stressful, not to mention painful, but that doesn’t mean your dream of owning a home is entirely shattered.

Here’s another set of Pag-IBIG housing loan tips for dealing with a denied application.

🏠 Get a Co-Borrower

Pag-IBIG allows you to apply with a family member or two for a single home loan. Relatives up to the second degree are accepted, so you can apply with your spouse, parent, sibling, in-law, or cousin. Since their income will be added to yours, the application has a better chance of getting approved.

However, be careful when asking someone to co-sign a loan with you. Not everyone in the family will agree to be responsible for any unpaid debts you make.

Choose a co-borrower with whom you’ll share the new home and who’s genuinely willing to help you out. Also, get one who can fulfill all the co-borrower requirements.

🏠 Buy a Lower-Priced Home

While scouting for a new home, you might stumble upon your dream house. But can you actually pay the monthly amortization without any struggle?

If you want your application to be approved, buy a home you can afford. Even if you purchase property that doesn’t fit your idea of a dream home, you’ll sleep better at night knowing that you have a roof over your head and can afford to pay your monthly amortizations.

Keep exploring, and you’ll find thriving locations and communities with cheaper properties. If you’re not in a rush to move into a new home, consider buying a pre-selling property.

🏠 Consider Alternative Housing Loans

While the housing loan from Pag-IBIG is the top-of-mind choice of Filipino homebuyers, there are other ways to finance your dream home.

Bank financing is another viable way to borrow money for a home purchase. Home loans from banks offer competitive rates (around 5% to 6%). But like the Pag-IBIG Fund, banks have strict requirements and credit evaluations for borrowers.

Consider in-house financing as well. Instead of going through a third-party lender, a homebuyer directly deals with the seller or property developer to avail of a home loan.

The requirements are minimal, and the process is simple and straightforward. However, in-house financing has higher interest rates and shorter payment terms than other housing loan providers.

Read more: How to Find the Best Housing Loan: A Step-by-Step Guide

Pag-IBIG Housing Loan Tips: FAQs

The Pag-IBIG Housing Loan tips above will help you increase the odds of your application’s success. But if you have other questions, you may find the answers here.

1. How much monthly income do I need to be approved?

Pag-IBIG sees to it that your monthly repayment will not exceed 35% of your monthly income. If your monthly installment for the housing loan is ₱7,000, then your salary should be higher than ₱20,000.

Find out how much you can afford for the monthly amortizations. This way, your budget will not be significantly affected.

2. What can I do if my salary isn't enough?

Try looking for other sources of income. Pag-IBIG considers other types of income sources, including freelance gigs. Just submit proof of regular remittances from your freelance employers for the last 12 months.

Submit these documents if you don't have a Certificate of Employment, or if you have a low income:

- Commission vouchers with the issuer’s names

- Certified True Copy of Transport Franchise from LGU for tricycle drivers and LTFRB for drivers of other public utility vehicles

- Copy of contract of lease and tax declaration for those who own a rental property

- Barangay certificate and notarized Certificate of Engagement for owners of sari-sari stores, on-call maintenance personnel, technicians, and owners of mini groceries

3. I have other loans from banks. Will this affect my Pag-IBIG home loan application?

Does Pag-IBIG check credit scores? Pag-IBIG’s Housing Loan credit investigation aims to see if borrowers have loan delinquencies. Outstanding debts from banks or other lenders will not affect your loan application, as long as all your total loan repayments can still be covered by your regular income and you’ve paid your dues on time.

4. I don’t have a total of 24 months' savings or contributions. What can I do to qualify for a housing loan?

Pag-IBIG allows a lump sum payment of contributions and savings. So if you have enough cash on hand, then you can make a one-time payment to comply with this requirement.

5. How can I process my Pag-IBIG Housing Loan payments?

You can repay your Pag-IBIG Housing Loan via the following methods:

- Salary deduction via Employer Collection Servicing Agreement (CSA)

- Auto debit arrangement (ADA) with banks

- Post-dated checks

- Virtual Pag-IBIG

- Any Pag-IBIG branch

- Accredited collection partners

- Online payment channels

Pag-IBIG has a list of accredited collection partners where you can settle your payments:

- Asia United Bank (AUB)

- Metrobank

- LANDBANK

- Bayad Center

- SM Bills Payment

- ECPay

- GCash

- Maya

- CashPinas

Final Thoughts

Owning a real estate property seems like an elusive dream, but you have the Pag-IBIG Fund to back you up financially. The application process can be complicated and demanding, but remember the benefits: a lower interest rate and a convenient payment term.

If you want to fast-track your application process and get approved, keep the above-mentioned Pag-IBIG housing loan tips in mind. Get in touch with Pag-IBIG personnel for other details, such as additional documentary requirements.

If you get rejected, don’t lose hope. There are other home financing options in the Philippines, such as housing loans from banks, that you can avail of at competitive rates:

|

Provider

|

Loan Amount

|

Monthly Add-on Rate

|

Loan Term

|

Minimum Annual Income

|

Approval Time

|

|---|---|---|---|---|---|

|

UnionBank Personal Loan

|

Up to ₱2 million

|

26.9% per annum

|

12 to 60 months

|

₱250,000

|

As fast as 5 minutes

|

|

UNO Digital Bank Personal Loan

.png?width=149&height=52&name=Unobank-Logo-Colored_Horizontal-Medium%20(for%20MMX).png) |

₱10,000 to ₱500,000

|

1.79% per month (corresponds to annual contractual rates or annual percentage rates ranging from 35.78% to 37.54%)

|

Six to 36 months

|

₱240,000

|

Five to seven banking days

|

|

Metrobank Personal Loan

|

₱20,000 to ₱2 million

|

1.25% to 1.75%

|

36 months

|

₱350,000

|

Seven banking days

|

|

BPI Personal Loan

|

₱20,000 to ₱3 million

|

Maximum annual contractual rate of 28.67%

|

12 to 36 months

|

Inquire with BPI

|

Five to seven banking days

|

|

Tonik Credit Builder

|

₱5,000 to ₱20,000

|

4.84%

|

Six to 12 months

|

Inquire with Tonik

|

Two banking days

|

|

Tala

|

₱1,000 to ₱25,000

|

0.43% daily

|

Up to 61 days

|

None

|

Five minutes to 24 hours

|

|

HSBC Personal Loan

|

₱30,000 to ₱500,000

|

0.65%

|

Six to 36 months

|

₱168,000

|

Five to seven banking days

|

|

CIMB Personal Loan

|

₱30,000 to ₱1 million

|

As low as 0.83%

|

12 to 60 months

|

₱180,000

|

One to two banking days

|

|

Maybank Personal Loan

|

Up to ₱1 million

|

1.3%

|

Up to 36 months

|

₱300,000

|

Inquire with Maybank

|

|

RCBC Bank Personal Loan

|

₱50,000 to ₱1 million

|

1.3%

|

Six to 36 months

|

₱360,000

|

5 to 7 banking days

|

|

PSBank Personal Loan

|

₱20,000 to ₱250,000

|

|

24 or 36 months

|

₱180,000

|

Five to nine banking days

|

Sources:

- [1] Pag-IBIG home loan releases hit record-high P57.07B in H1 (Philippine News Agency, 2023)

- [2] Affordable Housing Loan for Minimum-Wage and Low-Income Earners Frequently Asked Questions

- [3] Pag-IBIG Fund lowers home loan rates (CNN Philippines, 2023)

- [4] Pag-IBIG Housing Loan

- [5] Pag-IBIG Citizens Charter 2023

- [6] Credit Information Corporation

- [7] Pag-IBIG Housing Loan Affordability Calculator

- [8] Properties for Sale (Acquired Assets)

_1200x350_CTA.png?width=734&height=214&name=UB_PL_Generic_Ad_-_Home_Improvement_(Sep_2023)_1200x350_CTA.png)

_1200x350.png?width=751&height=219&name=UB_PL_Generic_2_(Jan_2025)_1200x350.png)