“I’ll invest when I get a raise.”

“I’ll invest when I have X amount.”

“I’ll invest when I’m debt-free.”

These are common statements we hear when we ask the question “Are you ready to invest?” Even though the myth of needing hundreds of thousands to invest has been debunked, Filipinos are still wary of investments. Even as the Philippines has been dubbed ‘Asia’s rising tiger’, less than 1% of the population invests in stocks, bonds, UITFs, and the like.

Fortunately, peso cost averaging (PCA) makes investing a whole lot easier – and cheaper. It is an investment strategy that allows you to save and grow your wealth even if you don’t have the money for a large lump sum investment.

Read more: 5 Stock Trading Strategies for Aspiring Traders

What is Peso Cost Averaging?

Peso cost averaging, or PCA, is the investment strategy of buying investments of a blue-chip stock at regular intervals for a predetermined amount of time, at least three years. For example, you buy around Php 5,000 worth of a certain stock every month, no matter its current share price. Let’s say its share price today is Php 100. With Php 5,000, you can buy 50 shares. But if next month it goes up to Php 200/share, you only buy 25 shares. If in the next month it goes down to Php 50/share, you buy 100 shares. It’s not the price of the stock that’s most important; it’s staying consistent with how much money you’re investing every month and sticking to your time frame.

Peso cost averaging allows you to consistently invest a set amount with a good potential for growth while lessening your risk.

Read more: 3 Things To Do When The Philippine Stock Exchange Is Down

What are the benefits of PCA?

To make things simpler, peso cost averaging in this article will be discussed in relation to stocks; however, the same principles follow for mutual funds and UITFs. Peso cost averaging allows you to minimize your risks because you are spreading out your investments over a certain period. This allows you to buy stocks at different prices versus buying a lump sum investment at a set price.

If you look at the graph below, you can see how the stock price for BDO Unibank, Inc. (BDO:PS) fluctuates up and down. On October 1, 2014, the price for one share was Php 97. Just in the span of 6 months, the price increased by 27% to Php 123 on April 1, 2015. Peso cost averaging allows you the opportunity to buy more shares when the price is cheaper.

[caption id="attachment_6734" align="aligncenter" width="730"] Graph 1: changes in BDO stock prices over a two-year period[/caption]

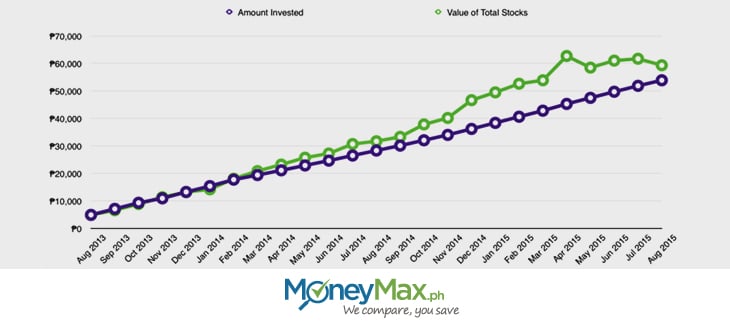

Graph 1: changes in BDO stock prices over a two-year period[/caption]The graph below shows the relationship between the amount you invested and the total value of your stocks. As you can see below, while the amount you invested grows at a steady rate (Php 2,000 per month), the actual value of your investment grows faster, giving you around a 10% return on an investment after two years. The longer you stay invested, the greater the potential for growth.

[caption id="attachment_6732" align="aligncenter" width="730"] Graph 2: the relationship between the amount of money invested and the total value of stocks. Note: the value of the investment does not take into account all the fees involved, which can reduce your gains.[/caption]

Graph 2: the relationship between the amount of money invested and the total value of stocks. Note: the value of the investment does not take into account all the fees involved, which can reduce your gains.[/caption]Unlike peso cost averaging, lump-sum investing can be riskier. If you bought Php 54,000 worth of BDO shares last March 2, 2015, at Php 110 and sold them last August 3, 2015, at Php 100.60, you would have experienced a -8.55% loss. Peso cost averaging minimizes your risks by enabling you to spread your money and buy stocks at cheaper prices.

Read more: COL Financial Review and Beginner’s Guide to Stock Investing

How do I come up with my PCA strategy?

- Set a budget or amount for your investments

- Decide your frequency for investing

- Plan your time frame

- Opt for blue-chip stocks

1. Set a budget or amount for your investments

“The market is available for everyone, but the exposure one can put varies,” says Marvin Germo, bestselling author of the Stock Smarts series of books. Don’t put in money you can afford to lose, and only invest a set percentage of your budget to investments.

Investments, such as stocks and UITFs, are less liquid than savings accounts. It will take you more than a day before you see the money deposited to your bank account, so it’s best to invest money you won’t need for emergencies or daily expenses. For some, this amount may be Php 10,000 while for others it may be Php 1,000. No matter the amount, what is important is that you are investing rather than not investing at all.

2. Decide your frequency for investing

This all depends on you, but it is recommended you invest on a monthly basis every time you receive your paycheck. The importance of investing at regular intervals is it builds the habit of properly handling your finances. If you are self-employed or a freelancer, you can still invest once a week, every two months, or every four months.

What’s important is you set a budget for investing and put in money regularly even if your income is irregular.

3. Plan your time frame

Always invest with a goal in mind – this will help you set your time frame. In the stock market, it’s recommended that you stay invested for at least three years. Saving up for a house down payment? That should take around 5 – 7 years. For retirement? Even longer. Having an end in mind will make it easier for you to stick to your schedule.

4. Opt for blue-chip stocks

Most importantly, when peso cost averaging, it’s best to stick with blue-chip stocks, or stocks of well-established companies. These are mostly market leaders in their respective industries – think Ayala Land, Inc. (ALI:PS), SM Prime Holdings, Inc. (SMPH:PS), and PLDT (TEL:PS). Complementing peso cost averaging with buying blue-chip stocks minimizes your risk even more because you are buying shares of companies with longstanding histories of stability and consistent earnings.

Read more: How to Pick Stocks in PSE: Helpful Tips for Beginners

Is peso cost averaging for everyone?

Peso cost averaging is a good strategy to minimize your risk by buying shares at different prices. Also, injecting money at regular intervals allows you to form the habit of investing which translates to other areas of your finances, such as loan payments, savings, and others.

If you’re looking for large gains, PCA is not for you. Because you’re minimizing your risk, you’re also missing out on maximum gains.

But for newbie investors who are not yet familiar with fundamental and technical analyses, peso cost averaging is a good strategy to learn the ins and outs of the stock market. After a few years of peso cost averaging, you can feel more prepared to go into more serious investing.

Read more: How to Invest in Stocks for Beginners (Even with Little Money)