Opening a new business in the Philippines soon? A critical task you should make time for is your business permit application. This document is your proof that you can legally operate in the city or town where your business is located—whether it’s a physical store, a courier service, an online shop, or any enterprise.

Learn how to get a business permit properly, so you can set up your business without a fuss. Here’s everything you need to know about business permits in the Philippines.

What is a Business Permit?

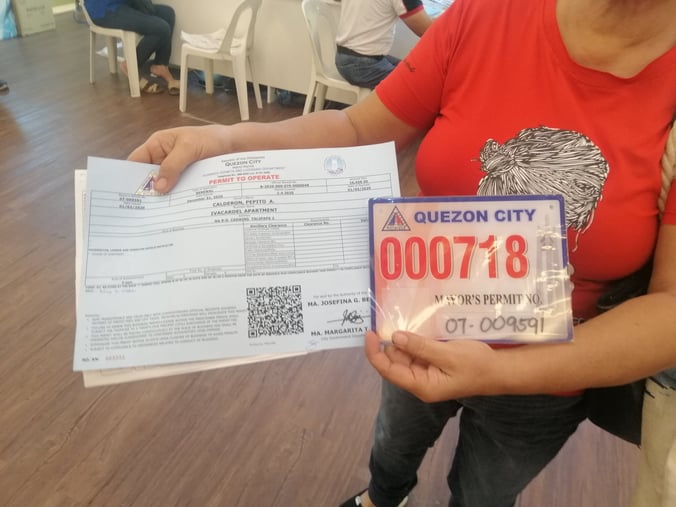

In the Philippines, a business permit is a certification that your business is legitimate and authorized to operate in the city or municipality where it’s registered. This official document is also called the mayor’s permit because it’s processed by the local government unit (LGU) with jurisdiction over the place of business.

A business permit is issued to ensure that a business pays taxes and complies with local regulations for safety, security, health, and sanitation. This document also entitles an individual or organization to any support provided by LGUs to businesses in their area.

Why Should You Apply for a Business Permit in the Philippines?

-Oct-13-2023-08-27-14-4948-AM.png?width=674&height=449&name=Pics%20for%20blog%20-%20600x400%20(21)-Oct-13-2023-08-27-14-4948-AM.png)

As a new entrepreneur, you have a lot on your plate as you prepare for your business launch. Despite that, it’s important to make your business permit application a priority.

Why? First, it’s required by law. Sole proprietors, partnerships, corporations, cooperatives, foundations, and associations in the Philippines need to get a business license from their respective LGUs before they start operations.

Second, a business permit in the Philippines is one of the requirements for applications for business loans, government financial assistance programs, BIR registration, and other related transactions. It may also be required when you apply as an authorized reseller/distributor of a brand or as an online seller on e-commerce marketplaces.

In short, you need to get this permit first, so you can set up your new enterprise smoothly.

❗ What Happens If You Don't Secure a Business Permit?

Running an enterprise without this permit can result in penalties such as fines and imprisonment. The LGU may close the operations until a business permit is secured.

In case you're wondering, this doesn't just apply to small businesses—even big companies have to face the consequences, like when the Makati LGU shut down the Smart Communications Inc. headquarters in February 2023 for allegedly operating without a valid business permit and failing to pay billions' worth of taxes.[1]

Business Permit Requirements 2023: 6 Documents to Prepare

Before applying for a business permit, you need to register your business with the appropriate government agencies and secure other clearances and permits. These take time and effort to process and obtain.

Here are the required documents for your business permit application in the Philippines:

📋 Fire Safety Inspection Certificate

To get this certificate, you must have the following:

- Building permit and building plan

- Barangay Business clearance

- Fire insurance coverage

- Proof of compliance with requirements and recommendations from fire safety inspectors

📋 Sanitary Permit

Prepare the following requirements for a sanitary permit:

- Most recent chest x-ray results of the business owner

- 1x1 photo

- Inspection certificate of the establishment

- Receipt of paid Sanitary Permit Fee and Sanitation Inspection Fees

- Medical Certificate and Health Card issued by the City Health Officer

📋 Building Permit and Electrical Inspection Certificate

Submit the following requirements to secure a building permit and electrical inspection certificate:

- Building plans

- Lot plan

- Clearances from the homeowners association, barangay, or any other authorized offices

- Fire safety requirements

- Contract of lease and authorization of owner (if rented)

- Title, tax declaration, a tax receipt (if owned)

- Contractor’s business permit

- Sketch of your business location

- Bill of materials, specifications, structural computation

- Copy of License of the Engineer

📋 Certificate of Occupancy

To get a Certificate of Occupancy, here are the things you need to provide:

- Images or photos of the site

- Fire Inspection Certificate

📋 Locational Clearance

For the locational clearance, submit the following:

- Pictures of the site

- Fire Inspection Certificate

- Building Permit

- Authorization letter from the owner (if rented)

- Electrical Permit

- Sanitary Permit

- Certification of Non-Improvement

- PRC License /PTC of the Engineer

📋 Electric Utility Connection

For the electric utility connection, these are the required documents:

- Letter of request from the owner

- Electrical plan

- DTI Registration or Copy of SEC Registration with Articles of Incorporation

- Copy of Lease Contract, Transfer of Certificate Title (TCT), or Deed of Sale

- Company SSS number or Tax Identification Number (if SEC/DTI Registration is not available)

💼 Launch or Expand Your Small Business With a UnionBank Personal Loan

Ready to start or grow your small business? If you're planning to secure funds to buy inventory, pay for a bigger space, or hire employees, check out what UnionBank has to offer. Borrow funds up to ₱2 million and get your loan disbursed in as fast as 24 hours.

Where to Get Business Permit Requirements

Depending on the type of business you own, there are several government agencies involved in your business permit application.

👉 Department of Trade and Industry (DTI)

Purpose: Business name registration

All businesses, including single proprietorships, partnerships, corporations, and cooperatives should register for a business name with the DTI to begin the business permit application process.

Partnerships, corporations, and cooperatives should submit a Certified photocopy of the SEC and Articles of Incorporation or Partnership.

👉 Securities and Exchange Commission (SEC)

Purpose: When corporations and partnerships need to apply for an SEC registration

For a partnership or corporation to be regarded as a legal entity, it has to register with the SEC. You can file for your company's business registration at the SEC head office (Secretariat Building, PICC Complex, Roxas Boulevard, Pasay City).

Alternatively, online SEC registration can be done via the eSPARC (Electronic Simplified Processing of Application for Registration of Company) facility, which can be accessed through esparc.sec.gov.ph/application.

👉 Barangay Unit

Purpose: Applying for Barangay Business Permit and Clearance

After registering a business name, first-time entrepreneurs should go to the Barangay Unit where the business is located and apply for a business permit and clearance. You'll be required to submit a Community Tax Certificate and pay the Barangay Clearance fee, which is around ₱200.

👉 City or Municipal Office (Business Permit and Licensing Office)

Purpose: Securing all requirements for a Business or Mayor’s Permit

This is necessary if you have your own building or physical store. However, you may not need to get one if your business is located inside a mall. The mall management will be responsible for conducting the inspection and issuing the certificate.

In a Nutshell: Business Permit Requirements in the Philippines

To sum up, here are the typical requirements for a business permit that you have to obtain in the following order:

| Business Permit Requirement | Purpose | Where to Get It |

|---|---|---|

|

Applicable business registration document:

|

Proof of business registration

|

|

|

Barangay Business Clearance

|

Proof of business location

|

Barangay hall with jurisdiction over the business location

|

|

Proof of business location and existence

|

Owner or building administrator of the leased property (if renting)

|

|

Sketch and photos of the location

|

Proof of business location and existence

|

Owner or building administrator of the leased property (if renting)

|

|

Locational Clearance / Zoning Clearance

|

Proof of compliance with the city’s/municipality’s Comprehensive Land Use Plan and Zoning Ordinance

|

City Planning and Development Office of the city/municipal hall

|

|

Occupancy Permit

|

Proof that the structure where the business will operate has passed safety and health standards

|

|

|

Public Liability Insurance

|

Protection against legal liabilities as a result of bodily injury/property damage to third parties in connection to the insured’s business operation

|

Any Insurance Commission-accredited insurance company

|

|

Authorization letter/Special Power of Attorney and valid ID (if filed through a representative)

|

Proof that the person is authorized to transact on behalf of the business owner

|

Business owner

|

Note: Every LGU has its unique set of requirements for a business permit in the Philippines. Your LGU may also impose additional requirements, taxes, and fees for business permit applications. To know what else you need to secure and how much the fees are, contact your mayor's office or visit your LGU's website.

How to Apply for a Business Permit in the Philippines

📌 How to Get a Business Permit via Walk-In Application

The procedure for new permit applications varies per LGU. But to give you an idea of what to expect, here are the general steps to remember when you apply for a business permit.

- Go to the Business Permit and Licensing Office (BPLO) within the premises of the city/municipal hall having jurisdiction over your business address. Alternatively, you may conveniently apply for a new business permit or renewal at off-site locations in malls (such as SM, Robinsons, Ayala, and Vista Malls) that have partnerships with your LGU.

- Secure and fill out the application form. The form is available on-site. You can also download it in advance from the LGU's website.

- Submit the accomplished application form and other requirements. The personnel will evaluate your documents. Your application will also undergo an assessment of tax and fees.

- Pay for the assessed tax and fees to the cashier once approved. Receive your official receipt.

- Claim your business permit. The document may be issued together with a registration plate/sticker or any other certificate. Make sure to display them prominently in your store or office.

📌 How to Get a Business Permit Online

Wondering if you could save time by getting a business permit online? Check your LGU's official website to see if it has an online business permit application service.

For example, if you plan to open a business in Manila,[2] Valenzuela,[3] Pasig,[4] Muntinlupa City,[5] Quezon City,[6] Parañaque,[7] Pasay,[8] and Marikina,[9] just to name some, you can use the city's website or mobile app.

Still, you can opt to apply personally via a walk-in procedure. Just submit the requirements or through your authorized representative to the city or municipal hall where your business is located.

The advantage of a walk-in vs online business permit application is that you can ask the person in charge any question you may have. You get the answers and the assistance you need right away.

- Online Business Registration in the Philippines: Make Your Biz Legit

- How to Register in PhilGEPS to Secure Business-to-Government Projects

Business Permit in the Philippines: FAQs

-Oct-13-2023-08-42-54-0557-AM.png?width=674&height=449&name=Pics%20for%20blog%20-%20600x400%20(22)-Oct-13-2023-08-42-54-0557-AM.png)

1. How much does a business permit cost in the Philippines?

Business permit fees differ depending on your location. But here are some fees you should pay when processing your business permit application.

- Business permit processing fee: ₱500

- Mayor’s permit fee: ₱100

- Sanitary fee: ₱150

- Building inspection fee: ₱200

- Electrical inspection fee: ₱20

- Plumbing: ₱15

- Signboard: ₱50

- Fire: ₱300

- Sticker: ₱50

2. Can I operate immediately after I receive my business permit?

Yes, you can start your business operation once your permit application is approved. But don't forget to secure the following documents as well:

- Business TIN and Certificate of Registration from the BIR

- Business SSS Number

- Pag-IBIG Employer-Member Registration

- PhilHealth Employer-Member Registration

3. Is a business permit required to open a sari-sari store?

Owners of sari-sari stores and karinderyas still need to operate legally and must secure a business permit. However, take note that some LGUs don’t require Public Liability Insurance for these types of businesses.

4. What are the requirements for business permit renewal?

Each LGU has a different set of business permit requirements for renewal applications.

Take Makati’s business permit renewal[10] requirements below:

- Three copies of the notarized application form

- Declaration of Gross Sales from the previous year

- Number of employees

- Paid-up capital

- Copy of last year’s Business Permit and Billing Assessment

- Audited Financial Statement or Business Income Tax Return

- Community Tax Certificate

- Barangay Clearance

- Public Liability Insurance

- Affidavit of Low Income

5. When is the deadline for business permit application renewal?

Business owners are required to renew their business permits on or before January 20 of each year.

However, some LGUs extend business permit renewal deadlines. To know the actual due dates, check the official website, Facebook page, or Twitter account of your LGU.

6. I registered my business last October 2022. Should I renew my business permit this October 2023?

No. All businesses, regardless of the date of registration, should be renewed before January 20 of each year. This means you don't need to renew your business permit exactly a year after your registration date.

7. What happens if I fail to renew my business permit?

Failure to renew your business permit may result in payment of a 25% surcharge on top of the tax assessed, and an additional 2% for each month that the business permit was not renewed.

You may also be asked by the BIR to pay a fine of ₱5,000 up to ₱25,000. Delinquencies may also lead to the closure of the business and the seizure of business assets.

Final Thoughts

The process of applying for a business permit in the Philippines may look tedious because of its long list of requirements, but it's a necessary one.

Remember that business permits should be renewed annually. Make sure to renew your permit between January 2 and 20 of every year to avoid penalties and suspension of your business license.

Sources:

- [1] Makati City shuts Smart main office over alleged ₱3.2 billion unpaid taxes, lack of business permit (CNN Philippines, 2023)

- [2] Business Permits | Lungsod ng Maynila

- [3] Valenzuela City Paspas Permit

- [4] Pasig City Online Services

- [5] City of Muntinlupa Business E-Payment System

- [6] The New Normal: Unified Business Permit Application (Quezon City Website)

- [7] Parañaque Business Permits and Licensing Office

- [8] Business Permits and Licensing Office - Pasay City

- [9] Business Permits and Licensing Office - Marikina City

- [10] 2022 Business Permit Renewal (My Makati, 2022)

_1200x350_CTA.png?width=734&height=214&name=UB_PL_Generic_Ad_-_Business_Expansion_(Sep_2023)_1200x350_CTA.png)

_1200x350_CTA.png?width=1200&height=350&name=UB_PL_Generic_Ad_-_Business_Expansion_(Sep_2023)_1200x350_CTA.png)