For a lot of Filipino breadwinners, one job isn’t enough. Those who have grand plans for the future also take on more roles to build their savings. If you work multiple gigs on top of your day job, consider yourself a mixed-income earner.

You might wonder how you’re supposed to organize your taxes. Your employer’s HR and accounting departments file your day job’s tax. But how should you file taxes for your other gigs?

You’ve come to the right place. We’ve put together a short guide on how to file ITR for mixed-income earners in the Philippines.

Who are Considered Mixed-Income Earners?

-Apr-02-2024-06-54-42-0855-AM.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(13)-Apr-02-2024-06-54-42-0855-AM.png)

Before you learn how to file taxes for mixed-income earners, you need to know first if you’re actually a mixed-income earner.

The Bureau of Internal Revenue (BIR) defines mixed-income earners as those engaged in trade/business/profession while also earning compensation income.[1] In other words, you’re a full-time employee at a legitimate company who also has a part-time job or a side business.

Mixed-income taxpayers are different from other types of taxpayers, such as employees and full-time entrepreneurs or industry practitioners. To understand this better, take a look at this table.

| Types of Individual Taxpayers | Definition |

|---|---|

|

Employees

|

Individuals earning purely compensation from employers

|

|

Full-Time Business People or Entrepreneurs

|

Individuals earning income purely from their business or practice of profession

|

|

Mixed-Income Earners

|

Individuals who receive compensation from employers and earn money from their trade or business, such as part-time jobs, consultancy, freelancing, etc.

|

It’s safe to say that the main basis for mixed income is a full-time job. Whether you’re a freelance writer, a part-time photographer, an influencer, or an online seller, you’re considered a mixed-income earner as long as you maintain a full-time job aside from your side gigs.

Read more: Ask Moneymax: What are the Types of Taxes in the Philippines?

How to Register as a Mixed-Income Earner

Before you file your taxes, the government must first recognize you as a mixed-income earner. To do so, register with the BIR using Form 1901. If you don’t, you won’t be able to pay your taxes.

The BIR Form 1901 is the tax form that self-employed or mixed-income earners use to register before they start their business or open a new branch. Here’s what you need to know about filing this form:

👉 Documentary Requirements

Prepare the following documents to register yourself as a mixed-income earner:

- Two copies of duly accomplished BIR Form 1901

- Government-authorized ID that shows your name, birthdate, and address (e.g. driver’s license, passport, NSO birth certificate, etc.)

- Professionals: LGU-issued Professional Tax Receipt or Occupational Tax Receipt

- Sole proprietors: DTI Certificate of Business Name Registration or a copy of Mayor’s Permit

- Individuals registering their business: Proof of Payment of Annual Registration Fee (ARF)

- BIR Form 1906 or the Application for Authority to Print Receipts and Invoices[2]

- Final samples of your principal receipts or invoices

Note: The BIR may require additional requirements, such as barangay clearance, Special Power of Attorney (SPA), or franchise documents, depending on your circumstances. Get in touch with the agency for the final list of requirements for filing Form 1901.

👉 How to File Your BIR Form 1901

Once you’ve collated all the necessary documents, complete the registration process with the following steps:

- Head to a Revenue District Office (RDO) and submit the requirements.

- Pay the Annual Registration Fee at an accredited bank. The teller will issue the proof of payment you’ll present to the RDO.

- Pay the Documentary Stamp Tax and Certification Fee.

- Attend the taxpayer’s briefing. At this seminar, you’ll learn your duties and rights as a taxpayer.

What is the BIR Form Mixed-Income Earners Need for ITR?

Now that you’re a duly registered mixed-income earner, you can already file your taxes. Wondering which BIR form mixed-income earners should use? You only need to remember four numbers: 1701.

Mixed-income earners need to file the BIR Form 1701 in accordance with Section 51 of the Tax Code.[3] Other than mixed-income earners, the individuals below should also file this tax return regardless of the amount of their gross income:

- A resident citizen working in trade, business, or practice of profession within and without the Philippines

- A resident alien, non-resident alien, or non-resident citizen engaged in trade, business, or practice of profession within the Philippines

- A guardian of a minor, trustee of a trust, administrator/executor of an estate, or any individual acting in any fiduciary capacity for any person, where such trust, estate, minor, or person is engaged in trade or business

When to File Your Income Tax Return

The deadline for filing income tax returns in the Philippines for mixed-income earners is on April 15, 2024.[4]

Failure to meet the deadline will result in penalties such as a 25% surcharge of the tax due and an additional 12% interest per year.

File yours earlier to avoid missing the deadline and to correct any tax miscalculations ahead of time.

Read more: What Happens If I Don’t Pay My Taxes? Tax Evasion Penalties Every Taxpayer Must Know

How to File Your Income Tax Returns in the Philippines

Mixed-income earners can choose from three ways of filing their income tax returns: Electronic Filing and Payment System (eFPS), Electronic BIR Forms (eBIRForms), and manual filing.[5] Here’s how each of these methods works:

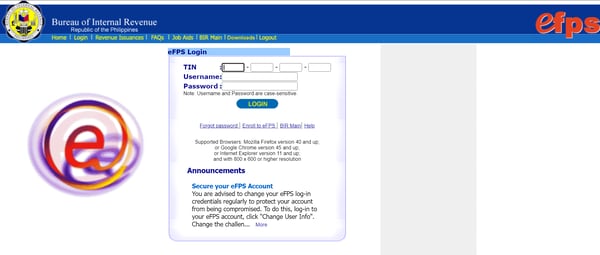

📌 Electronic Filing and Payment System (eFPS)

Wondering how to file your ITR online in the Philippines?

Developed by the BIR, the eFPS is a system for the paperless filing of ITRs and paying taxes through the internet. It’s a quick, convenient, and secure way to file and pay your taxes. The usage of the system, from enrollment to tax filing, is free of charge.

Who Can Use the eFPS?

The BIR built this electronic tax filing and payment system mainly for the largest taxpayers in the Philippines. But presently, all taxpayers in the country who need to file and pay their taxes can use the eFPS.

How to Register in the eFPS

Enrolling in the eFPS is easy. Here are the steps you need to take:

- Go to the BIR website at www.bir.gov.ph.

- From the dropdown, choose I want to use e-BIR Services.

- Click the eFPS icon to access the eFPS homepage.

- On the eFPS homepage, click the Enroll to eFPS link.

- You’ll be directed to the enrollment form. Complete the required fields then click the Submit button.

- Wait for an email from the BIR regarding the approval or rejection of your enrollment.

How to File and Pay Your Taxes Using the eFPS

Upon activation of your account, you can start filing and paying your taxes electronically through the eFPS. Here’s how to do it:

- Log in to your account.

- On the eFPS homepage, choose the form that applies to your taxpayer category.

- Fill it up accordingly and follow the prompts.

- Click the Proceed to Payment button found at the bottom of the page.

- Choose your payment mode. Select the most convenient for you.

- You’ll be then directed to another form. Fill it out and click the Submit button.

- You’ll be directed to the landing page of the bank you nominated in the registration. Pay your income tax on this page.

- Check your email to see if the bank sent you a confirmation message regarding your transaction.

Note: For a smooth registration, filing, and payment process, only use eFPS-supported browsers, such as the following: Google Chrome version 45 and up and Mozilla Firefox version 40 and up. In case you’re a Mac user, the eFPS also works on Safari.

📌 Electronic BIR Forms (eBIRForms)

The eBIRForms is an alternative method for easier, more convenient, and more accurate ITR preparation and filing. It consists of two packages that enable taxpayers to fill out their ITRs and submit them to the BIR online:

- Offline package – This downloadable tax preparation software allows taxpayers to encode data offline and validate, edit, save, print, and submit ITRs to the online eBIRForms system.

- Online package – This system accepts ITRs submitted online and automatically computes penalties for late filing of ITR.

Who Can Use the eBIRForms?

Non-eFPS filers may use this method. The government mandates certain taxpayers such as accredited tax agents and their clients to use the eBIRForms.

How to File and Pay Your Taxes Using the eBIRForms

For illustrative purposes, we’re going to use the offline eBIRForms package. Here are the steps that you need to take.

- Visit the eBIRForms page.[6]

- Download the latest version of the eBIRForms Offline package on the page.

- Install the package and open it.

- Choose the appropriate form. Enter the required information in the ITR. Once done, click the Validate button.

- Click the Submit/Final Copy button. Doing so automatically submits your ITR to the BIR system.

- Check your email to see if the BIR has already sent you a confirmation status. Print the said confirmation together with three copies of your ITR.

- Head to any accredited bank or RDO.

- Submit your ITR forms and requirements and pay your tax dues.

- Get your copy of the stamped ITR and deposit slip from the teller.

Read more: How to Pay Taxes in the Philippines with BIR Online Payment Channels

📌 Manual Filing

Unlike the two other methods of preparing and filing an income tax return in the Philippines, manual filing involves filing your ITR personally.

Who Can File an ITR Manually?

Taxpayers who are exempted from electronic filing of tax returns such as senior citizens and persons with disabilities (PWDs), as well as those who can’t use the eFPS and eBIRForms due to technical error or system maintenance, can file and pay their taxes manually.

How to File an ITR Manually

While it’s called manual filing, some steps still require you to access the internet, especially if you need to download the forms. The remaining steps, however, will need to be completed physically at BIR-accredited centers. Here’s what you need to do:

- Download, fill out, and print three copies of the accomplished BIR Form No. 1701.

- To pay your taxes, go to an accredited bank or RDO. Present the accomplished BIR form and the required documents.[7]

- Get your copy of the duly stamped and validated BIR form. This will be your proof that you’ve filed your ITR.

Note: Under the Ease of Paying Taxes Act, taxpayers can now file and pay their taxes at any Authorized Agent Bank (AAB) or RDO. Previously, taxpayers were required to do so only at their registered RDO.[8]

How to Get Your ITR Online in the Philippines

-Apr-02-2024-06-51-39-6570-AM.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(11)-Apr-02-2024-06-51-39-6570-AM.png)

Lost or forgot to keep a copy of your income tax return and wondering, "Where can I get my ITR?" Here are the different ways you can try to retrieve it:

👉 Contact BIR’s Customer Assistance Division

If you’re looking to get a copy of your ITR and other BIR-related documents, you may get in touch with the BIR’s Customer Assistance Division. Here are the contact details:

- Email: contact_us@bir.gov.ph

- Hotline: 8538-3200

- Trunkline: 8981-7000 or 8929-7676

👉 Check eFPS

Alternatively, you can use your eFPS account to see the tax returns you filed in the past. Log into your account, go to the eFPS User Menu, and click the Tax Return Inquiry button.

👉 Request Through the FOI Website

If you’re looking for another way to get ITR in the Philippines, you can do so through the Freedom of Information website. The Freedom of Information or FOI Program is the government’s response to the citizens’ call for transparency. Through this program, you can request any information about government transactions and operations as long as the information will not endanger national security.

Here’s how to request your ITR:

- Go to www.foi.gov.ph.

- Create an account if you don’t have one yet. Otherwise, just log in.

- Once logged in, you’ll be directed to the dashboard, which contains all the requests of the account owner.

- Click the Make a Request button and select the agency.

- After selecting the Bureau of Internal Revenue, click Write My Request.

- On the next page, fill out the form. Supply the details for the following fields:

- Tile of the document (in this case your income tax return)

- Coverage or time period

- Intended purpose of use

- Your message

- The request you sent will be forwarded to the Receiving Officer of the concerned agency.

- If your request is approved, you’ll find a response on your dashboard. Remember that the standard processing time is 15 working days.

Pointers to Remember When Using the FOI Website

The FOI program informs users that everything you input into its platform—which includes your name and message—will be publicly displayed on the website. If you’re not comfortable with the idea of making your name public, this may not be the best method for you.

The agency also asks requesters to make sure the information being asked for is not already publicly available. It also asks users to be very concise in their requests for a quicker release of information.

Here are two useful tips from the agency:

- Write the request in simple and precise language.

- The website is not made for general inquiries, so be very specific when naming the documents you want to retrieve. In your case, just state that you need your ITR.

How to Organize Your Taxes as a Mixed-Income Earner

-Apr-02-2024-06-53-24-3677-AM.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(12)-Apr-02-2024-06-53-24-3677-AM.png)

As a mixed-income earner, you need to be careful when dividing your time between your full-time job and side gigs. You can save a lot of time and effort if you know how to organize your taxes.

Avoid missed deadlines and penalties. More importantly, don’t let tax-related tasks permeate both your day job and side hustle.

Here are some things you need to keep in mind:

✔️ Create a Separate Bank Account for Your Business

Efficient financial organization starts with the creation of a separate account for your freelance work or business. That way, it’ll be easier for you to track your operation-related spending and tax-related deductions.

✔️ Record Everything

To keep tabs on your taxes and payments, implement a record-keeping system. It can be as simple as an Excel file or a columnar book. For the sake of efficiency, you can also use tech platforms, such as Taxumo and Tax Whiz PH.

✔️ Keep Your Invoices and Receipts

To better calculate your taxes, you’ll have to refer to your invoices and receipts. As such, you need to keep copies of them.

✔️ Set Money Aside for Your Taxes

Better yet, create a specific bank account dedicated to your taxes. While your overall tax largely depends on how much you’re making, it wouldn’t hurt to start saving early. That way, you won’t be shocked by how much you’ll need to pay eventually.

✔️ Seek the Services of a Professional

If you’re a super freelancer handling multiple projects and earning a sizable income, managing your taxes can be a headache. An accountant will not only help you keep track of your finances but also explain the confusing parts of taxation.

✔️ File Ahead of Time

Don’t wait for the BIR’s deadline before you actually file your ITR. The last days of the filing season can be hectic and stressful, and you may find yourself wasting time as you wait in line.

Prepare all the pertinent documents ahead of the deadline. Otherwise, you won’t have enough time to double-check your information, which may result in delays—or worse, penalties.

Final Thoughts

Does the thought of filing your ITR and paying your taxes seem daunting? It really is, especially if you’re a mixed-income earner who values time.

As such, you need all the help to get it done and make sure you're balancing your full-time job and freelancing career. Try using apps that can automate some of the tasks involved in tax preparation and filing, like calculating taxes and filling out forms.

Sources:

- [1] Definition of Mixed-Income Earners

- [2] BIR Form 1906

- [3] Tax Code of the Philippines

- [4] BIR warns taxpayers of hefty penalties for failing to file ITR on time (Manila Bulletin, 2024)

- [5] Guidelines in the Filing of Tax Returns Including the Required Attachments and Payment of Internal Revenue Taxes

- [6] eBIR Forms page

- [7] Guide to Income Tax

- [8] New year, new tax rules (PwC, 2024)