Download the Singlife Plan & Protect App today!

Easily purchase insurance products to secure your finances and save in the app to earn up to 5% tax-free interest yearly!

Download Singlife Plan & Protect App today!

Download today and use the promo code WOW250 to get FREE life insurance coverage worth 3x your monthly salary + 5% yearly interest tax-free!

What is the Singlife Plan & Protect app?

The Singlife Plan & Protect App is the first and only mobile app in the Philippines where you can get insurance directly through your phone!

✅ Take charge of your life insurance and investments

✅ Say goodbye to paperwork and endless agent interactions

✅ Get coverages that fit your budget when you need it

Singlife made it possible to SAVE, PLAN, and PROTECT

Protect

Get the insurance protection and investment products to help you achieve financial wellness.

✅ Income loss - Keep your income coming in the event of permanent disability or death

✅ Medical costs - Get cash to pay for your hospitalization and medical bills

✅Emergencies - Have at least 3x your monthly income coverage for emergencies due to disability or death

✅ Goals - Grow and protect your savings to help you achieve your life goals

Premiums are based on your age and monthly income, ensuring that recommendations remain flexible where you just pay for the coverage you need.

Plan

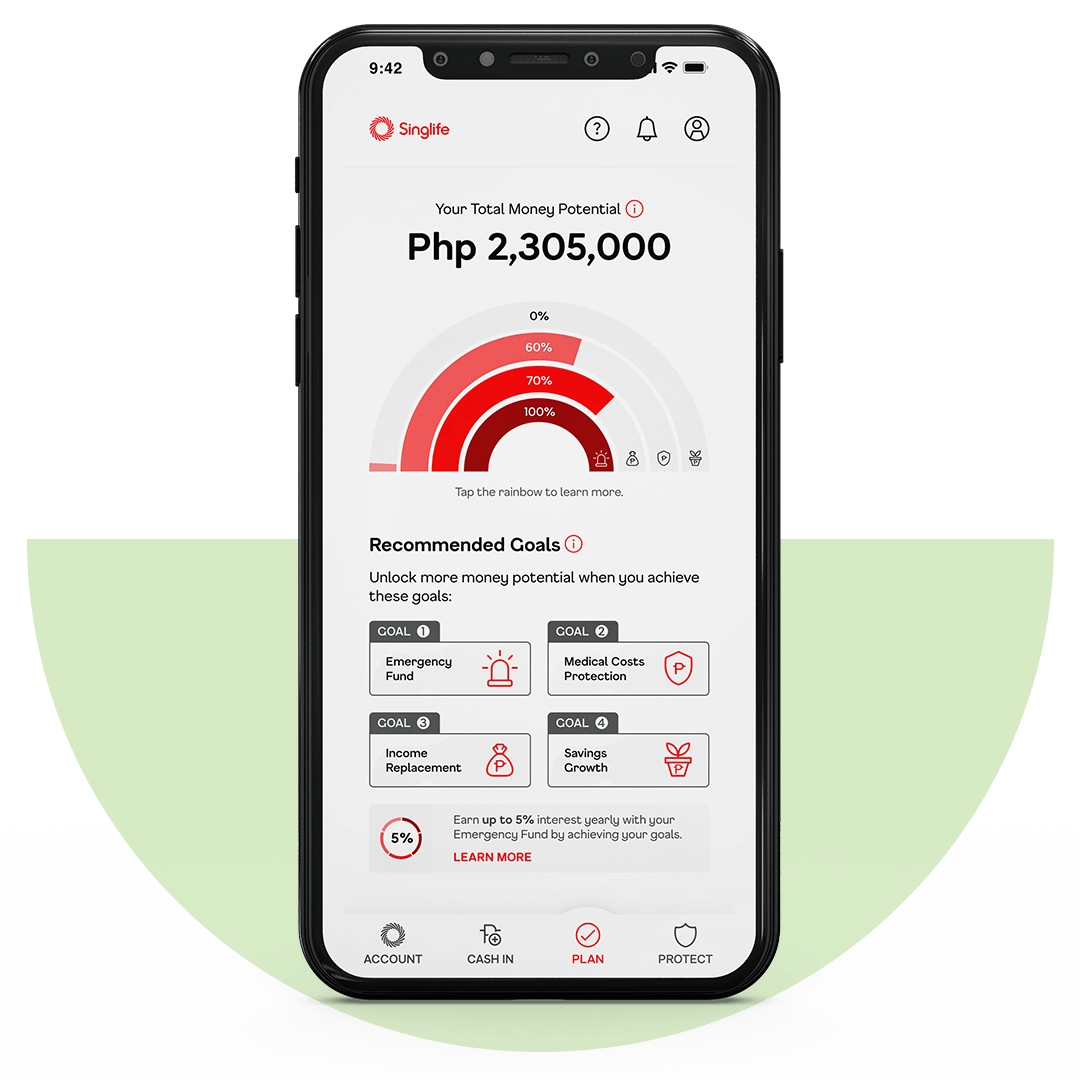

Get personalized financial advice tailored to your profile and life stage, and set and track your financial goals with smart recommendations just for you.

Save

Maximize your savings with the Singlife Account and earn an impressive tax-free annual interest rate of up to 5%.

Singlife Plan & Protect Benefits

Be the boss of your finances

No complicated application process, no insurance agents, hassle-free, 24/7 available, and you have full control of your savings and insurance since it’s all digital!

Customizable protect & plan solutions

The Singlife Plan & Protect App will provide personalized and customizable goals and insurance based on the monthly income you’ve declared.

Free Singlife Visa debit card!

Request for your free Singlife Visa debit card in the Wallet section of the App. Use it like a regular debit card when withdrawing cash via ATM or paying for your purchases and bills. Plus, enjoy zero fees when you withdraw at any UnionBank ATM.

Singlife App vs Traditional Insurance

Singlife Plan & Protect App

- Get insurance and investment products, build your emergency fund, and get financial planning advice all in one app!

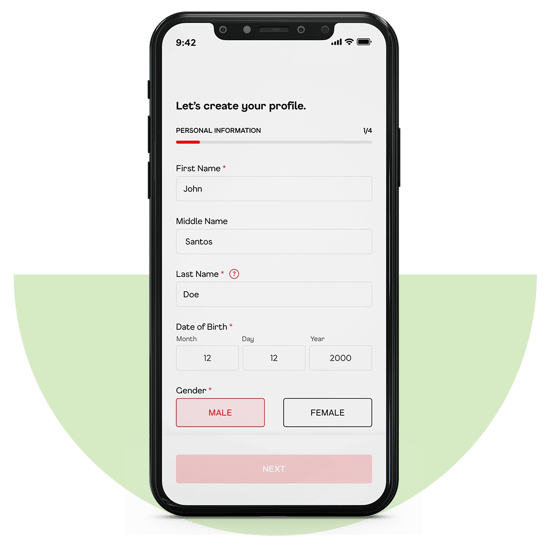

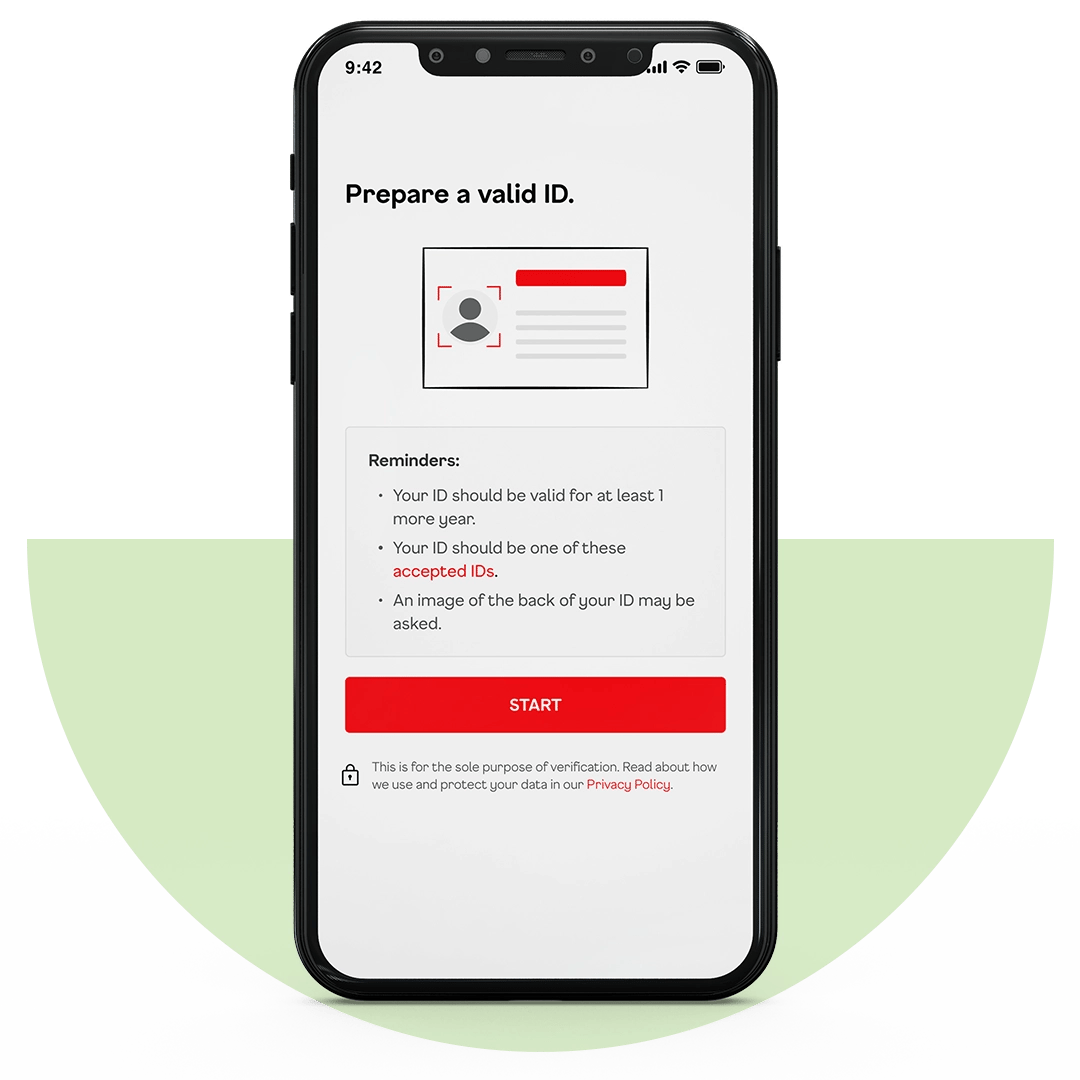

- Only minimal requirements for the application process—personal information, valid ID, and a selfie

- No need for insurance agents! Get direct access to your insurance and savings 24/7

- Customizable coverages to fit your budget

- Insurance policies are available through the app so you’ll always have access to it

- Offers savings and investment with insurance solutions, plus a Singlife Visa debit card!

Traditional Insurance

- Application process can be tedious because of numerous document requirements

- Meetups with insurance agents can cause delays and misunderstandings

- Insurance premiums can be a bit expensive

- Since insurance policies are printed on paper, it can get lost or damaged

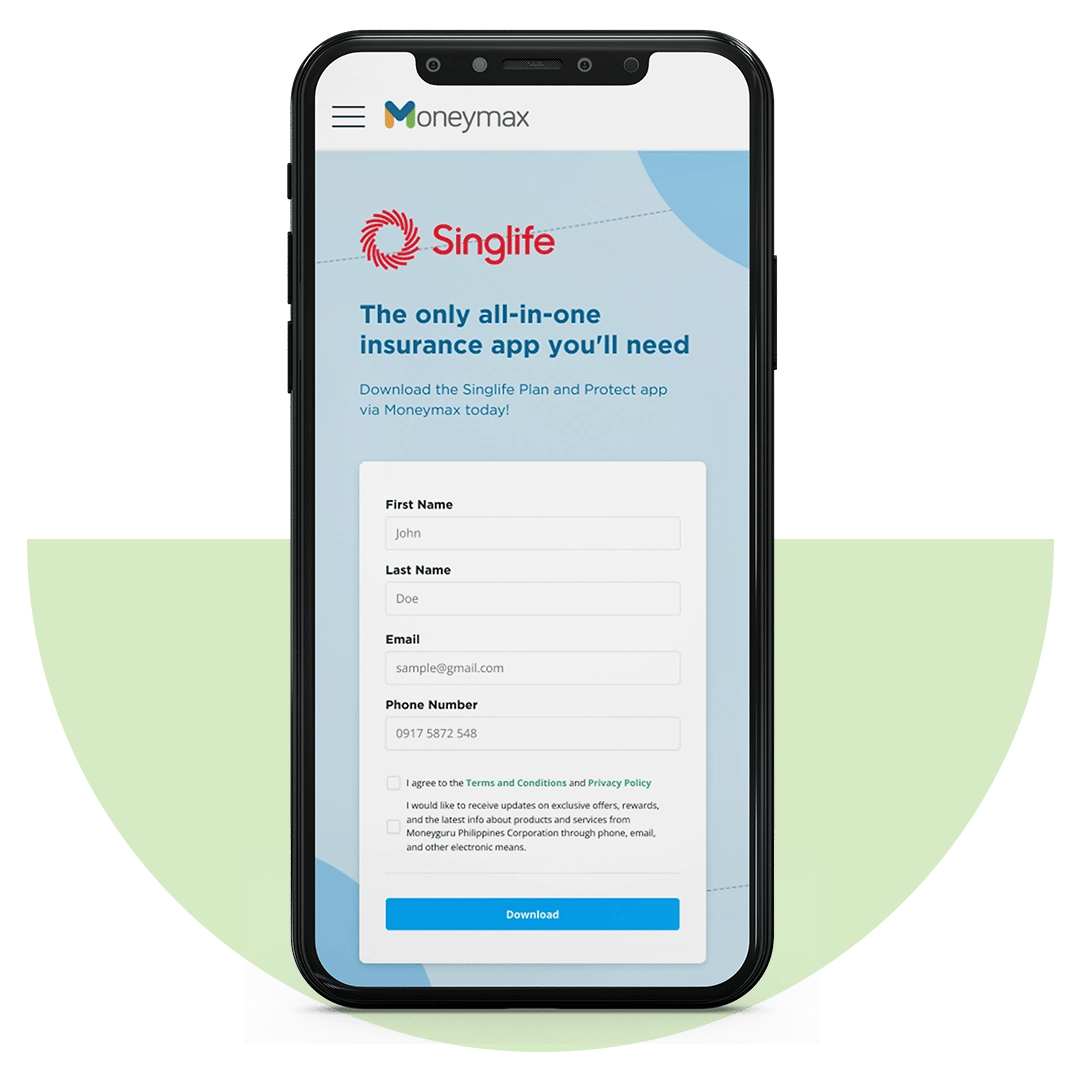

How to Download the Singlife App via Moneymax

Sign up via Moneymax today to download the app

Create a Singlife Profile

Verify your identity by taking a photo of your valid ID and a selfie

Start exploring Singlife’s protection products!

FAQs

Yes! Singlife is licensed and accredited by the Insurance Commission (IC) to operate as a Life Insurance company. Based in Singapore, Singlife is a mobile-first company with the goal of providing insurance solutions that fit every budget.

You are eligible to get the Singlife app if you meet the following criteria:

- Filipino citizen or foreigner who is a legal resident in the Philippines

- 18 to 55 years old

- Monthly net income of ₱25,000 to ₱150,000

Singlife insurance policies in the Singlife Plan & Protect App are on a ‘pay-when-you-need-coverage’ basis, meaning you can opt to avail of the insurance only when you need it. You can cancel your insurance policy anytime through the app. Auto-deductions will automatically stop once you cancel your policy.

No, Singlife is not an HMO but it’s a good addition to your HMO since it has insurance that will pay out cash benefit on top of your HMO coverage. That’s added assistance to your hospitalization and medical bills in case your HMO doesn’t cover your medical case or if you’ve maxed out your HMO coverage.

You can contact Singlife at +632 8299 3737. The hotline is available every day from 9 am to 8 pm. You can also email them at help@singlife.com.

Learn More About Insurance in the Philippines

Read more about insurance in the Philippines. Check out our articles below.

What is the Best VUL in the Philippines and How Does It Work?

A VUL insurance policy comes with pros and cons. Before investing your money, understand what a VUL is, its benefits, and its risks.

Investing Money for Beginners: How to Get Started in the Philippines

Learn the basics of investments for beginners in the Philippines in this guide.

Planning to be a Parent? Here’s What You'll Spend on Raising a Child

So before you make the big leap, know first the costs of raising a child in the Philippines and whether you’re financially ready for it.