Is your employer remitting the Pag-IBIG and PhilHealth government contributions being deducted from your salary?

These government agencies require all employers in the Philippines to remit their employees’ contribution payments every month or quarter. However, some employers don’t remit the mandatory government contributions in the Philippines.[1] Even if payroll deductions are reflected on your monthly payslip, they aren’t an assurance that your employer actually pays your contributions.

Yours should be up-to-date and remitted correctly, especially so you can qualify for housing and salary loans from Pag-IBIG if needed. This will also prevent delays in your availment of government benefits.

Learn how to check your PhilHealth and Pag-IBIG contributions below.

How to Check PhilHealth and Pag-IBIG Contributions

Is your employer remitting your contributions? Are your payments being posted? Here's how to track and monitor your PhilHealth and Pag-IBIG contributions.

📌 How to Check Your PhilHealth Contributions

There are three ways to verify your posted PhilHealth contributions: by checking the PhilHealth website, calling the agency's hotline, or contacting PhilHealth's Action Center channels.

Via the PhilHealth Member Portal

Can I check my PhilHealth contribution online? Yes—in fact, the easiest and fastest way to see your PhilHealth contribution remittance status is to use the PhilHealth Member Portal, the online facility for viewing your membership and contribution records.

Here's how to check your Philhealth contribution online:

- Go to the PhilHealth Member Portal[2] (memberinquiry.philhealth.gov.ph/member) and click on Create Account.

- Next, fill out the Member Portal Account Creation form with your basic information (including your PhilHealth number), assign a password, type the security code, and click the Create Account button.

- Activate your account by clicking on the link in the email from the PhilHealth Member Information System.

- Once you’ve activated your online account, you can check your PhilHealth contributions using the member portal. Just click on the Member Information page and click Premium Contribution on the left panel.

The Premium Contribution page shows the following information regarding your PhilHealth contribution payments:

- Member Contribution Payment Summary - This table shows your total contribution (total member share + total employer share) and the total number of monthly payments.

- Member Contribution Payment History - This table shows all your posted monthly government contributions since you started paying your PhilHealth contributions.

Via the Action Center Hotline

You can also make an inquiry via the Action Center Hotline, a 24/7 landline telephone-based service that can handle multiple calls from PhilHealth members regarding contribution status, membership, benefits, and other related concerns. Just dial 8-441-7442 and follow the instructions from the voice prompt.

Via Other PhilHealth Action Center Channels

Can't make a Philhealth Contribution inquiry using the online portal and the call center hotline? Try getting in touch with PhilHealth through any of these communication channels:

- Email: actioncenter@philhealth.gov.ph

- Facebook: /PhilHealthofficial

- Twitter: @teamphilhealth

- Callback channel: 0917-898-7442 (Text PHICcallback [space] mobile number or Metro Manila landline [space] details of your concern. PhilHealth will then make a call during office hours on weekdays only.

Related reading: PhilHealth Benefits Guide for Regular and Voluntary Members

📌 How to Check Your Pag-IBIG Contributions

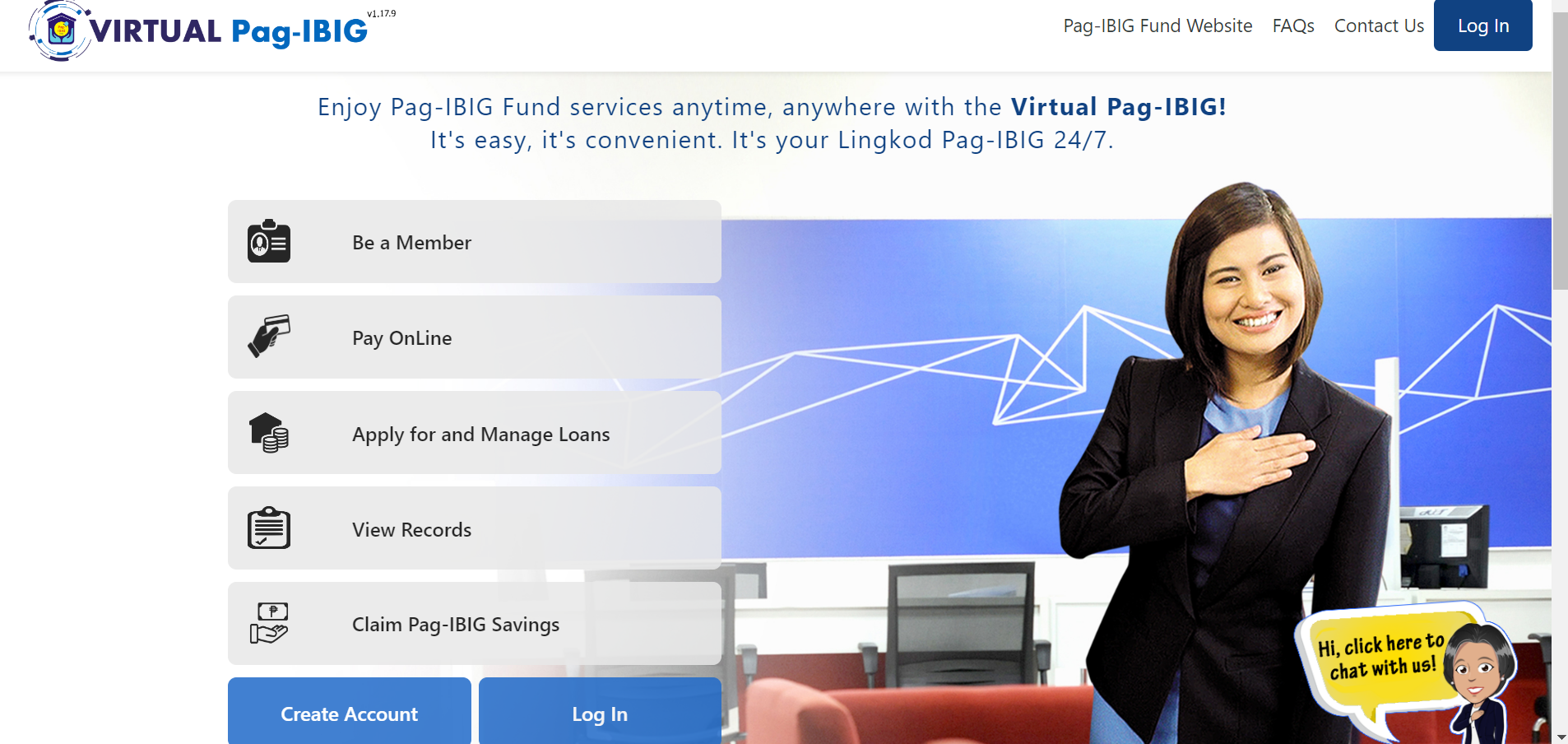

Pag-IBIG members can verify their paid government contributions via different channels: Virtual Pag-IBIG, email, Facebook, or call.

Via Virtual Pag-IBIG

Can you check Pag-IBIG contributions online? Yes. With a Virtual Pag-IBIG account, you can conveniently access Pag-IBIG services, including verification of contributions, anytime, anywhere.

Wondering how and where to check pag-IBIG contributions online in the Philippines? To check your Pag-IBIG contributions online, register for a Virtual Pag-IBIG[3] account first. Go to www.pagibigfundservices.com/virtualpagibig and then click the Create Account button.

Once done, here's how to check pag-IBIG contributions in 2023:

- Access Virtual Pag-IBIG and sign in to your account.

- Tap the menu on the upper left corner and tap Regular Savings (Mandatory Contributions).

- View your Pag-IBIG contribution details:

- Initial and last remittance dates

- Total employer share and employee share

- Total number of contributions, total dividends, and total savings

- To check your posted monthly contributions for a specific year, just enter the year at the bottom of the page and click the View Contributions button.

Via Email or Facebook Inquiry

Want to know how to check Pag-IBIG contributions online without registration? You can also check your Pag-IBIG contributions online by sending an email to contactus@pagibigfund.gov.ph or by sending a message to the Pag-IBIG Fund Facebook page at facebook.com/PagIBIGFundOfficialPage.

Before doing so, make sure you prepare the following details:

- Full name

- Birthdate

- Name of your past and present employers

The call center agent will ask you for such information to validate your identity before sharing details on your Pag-IBIG contributions.

Related reading: Government Social Media Accounts Filipinos Need to Follow

Via the Pag-IBIG Fund Hotline

You may also call the Pag-IBIG Fund 24/7 hotline at 8-724-4244 to check your Pag-IBIG contributions. You also have to provide your full name, birth date, and name of your past and present employers when making a phone inquiry.

Related reading: 9 Pag-IBIG Benefits You Probably Didn’t Know Yet

How to Check PhilHealth and Pag-IBIG Contributions: FAQs

-1.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(23)-1.png)

1. How to check my PhilHealth number using my name?

Did you happen to forget or misplace your PhilHealth number? Without it, you won't be able to log in to your PhilHealth account to check your contributions.

To know your PhilHealth number, contact the Action Center Hotline or any of the other PhilHealth Action Center channels mentioned above. You'll have to provide your name, birthday, other personal information, and possibly your TIN or SSS number.

2. How much is PhilHealth voluntary contribution?

Wondering how much to pay for your PhilHealth contributions if you're freelancing or self-employed? You'll have to remit 4% of your declared monthly income. See the brackets below:

- ₱10,000 monthly income - ₱400

- ₱10,000.01 to ₱79,999.99 monthly income - ₱400 to ₱3,200

- ₱80,000 and above monthly income - ₱3,200

Final Thoughts

Now that you know how to check your PhilHealth and Pag-IBIG contributions, you’ll see if there are years or months without posted contribution payments. In that case, notify your employer about it and ask about the discrepancies. Your company should be able to take action immediately; otherwise, it will have to face penalties for violating the law.[4]

If your employer takes too long to resolve the issue on your contribution remittances, you can report it to the concerned agency.

Sources:

- [1] Valenzuela factory owner in coin wage mess may face jail time for other violations — DOLE (Inquirer.net, 2021)

- [2] PhilHealth Member Portal

- [3] Virtual Pag-IBIG website

- [4] Imprisonment for non-remittance of SSS, Pag-IBIG, and PhilHealth contributions (Alburo Alburo and Associates Law Offices, 2017)