In the past, tracking one’s monthly SSS contributions meant visiting an SSS branch, calling the agency’s hotline, or coordinating with the HR department.

But technology has transformed the way we do things. These days, you don’t need to go through all that trouble if you know how to view SSS contributions online through the Social Security System member portal.

Plus, you can do more than just check your contributions with your SSS account. You can also view and access other SSS features.

Here’s a quick guide on how to check your SSS contributions online.

What are the Benefits of Checking SSS Contributions Online?

-Feb-01-2023-09-52-45-9431-AM.png?width=632&height=421&name=Pics%20for%20blog%20-%20600x400%20(1)-Feb-01-2023-09-52-45-9431-AM.png)

Learning how to verify your SSS contribution regularly is worth the time and trouble. Here’s why:

- If you’re employed by a company, you need to ensure that your employer is remitting the correct amount and doing it without delays.

- For self-employed or voluntary members, monitoring your SSS contributions will let you immediately know if you missed or made incorrect payments. You can then make the necessary adjustments as early as possible.

- If you plan to apply for an SSS Salary Loan or Calamity Loan, or claim other member benefits like SSS disability and SSS unemployment benefits, checking your contributions online can help you evaluate whether you’re eligible or not.

Why should you be meticulous about your contribution payments? To qualify for an SSS loan or benefit, you must meet the minimum monthly contributions within a certain period.

For example, you need at least 36 posted monthly contributions within the last 12 months when applying for an SSS loan. If you avail of a sickness or maternity benefit,[1] you need at least three monthly contributions within 12 months immediately before the semester of sickness, injury, or childbirth.

These are just some of the important reasons why you have to learn how to check your SSS contributions online.

Which SSS Contributions Can You Check Online?

There are different kinds of SSS contributions.[2] Know what they are in the table below.

| Feature | Monthly Contributions | SE/VM Contributions | WISP Plus | WISP |

|---|---|---|---|---|

| Description | Monthly payments done by employed individuals through their employers | Monthly payments made by self-employed individuals or voluntary members | Voluntary retirement savings scheme; includes Flexi-Fund and Personal Equity and Savings Option Fund | Tax-free retirement savings program |

| Enrollment / Membership | Automatic for employed individuals | Voluntary | Voluntary | Automatic for members whose monthly salary credit (MSC) exceeds ₱20,000 |

|

Coverage Applicability |

On the first day of employment | On the day of your first contribution payment | On the day of your first contribution payment | On the date of first posted contribution |

| Payment Sharing | 14% of your monthly salary credit divided as 4.5% from the employee and 9.5% from the employer |

Shouldered by the self-employed individual or voluntary member |

Shouldered by the OFW, private-sector worker, or self-employed member | Shared proportionately by the employee and the employer |

Regardless of what type of SSS contributions you’re paying for, always check whether the payments are posted and if the paid contributions are the correct amount required by the SSS.

💻 How to Check SSS Contributions Online via My.SSS

You need a My.SSS account before you can continue with your SSS contribution inquiry online. Once you’ve successfully registered for an online SSS account, proceed with these steps:

Step 1: Visit the SSS Member Portal

Access the SSS member portal at member.sss.gov.ph. Provide your My.SSS User ID and password.

If you forgot your user ID or password, click Forgot User ID or Password? under the Sign In button. You can either use your registered e-mail address or answer security questions to retrieve the information.

Follow the succeeding instructions about the retrieval or reset of your My.SSS account login details.

Step 2: Go to the SSS Contribution Inquiry Page

Hover your mouse on the Inquiry tab. Under this tab, click Contributions. It will then lead you to a page that contains the following:

- Monthly contributions

- SE/VM Contributions for Self-Employed or Voluntary Members

- Flexi Fund for OFWs

- Worker’s Investment and Savings Program (WISP)

- WISP Plus

Click the appropriate tab depending on which contribution you want to check. You’ll also see which months have no posted contribution. This may mean you were unemployed during those months or your employer hasn’t remitted your contributions yet.

Scroll down to view your total number of SSS contributions posted and your total amount of contributions paid. You can also save and print this page for your own quick reference.

Your SSS Contributions are summarized as follows:

- Total Number of Contributions Displayed

- Total Number of Contributions Not Displayed

- Total Number of Contributions Posted

- Total Amount of Contributions

SE/VM Contributions are summarized as follows:

- Number of Payments

- Total Amount of Medicare payments

- Total Amount of SSS Payments

- Total Amount of Payments

The WISP Summary should show:

- Beginning Account (amount)

- Current Year Contribution

- Investment Income

- Sub Total / Total

- Fixed Amount of Monthly Pension

When you see any inconsistencies or discrepancies in your SSS contribution online, ask your HR department about it (if you’re employed) or make the needed corrections (if you’re self-employed.) That way, you won’t encounter problems applying for an SSS loan or benefit claim in the future.

📱 How to Check SSS Contributions Online via the Mobile App

Navigating the portal can get tricky if you're using a phone and not a desktop. Want to know how to access SSS online quickly on your mobile device?

Just download the official SSS mobile app, which is available for iOS and Android devices. Then take the following steps:

Step 1: Log in to the SSS Mobile App

Use your My.SSS credentials to log in to SSS Mobile.

Step 2: Tap on the Total Contribution Button

On the main page, you’ll see your name, your SS number, the date of your last login to the mobile app, and your activity history. You’ll also see the number of your total contributions and the last posted contribution. Tap the corresponding tab to see the actual premiums and the total number of contributions posted.

💬 How to Check SSS Contributions via SMS

Even if you already know how to check SSS contributions online, you also have the option to check them via SMS.

How to check SSS monthly contributions using your SSS number?

Step 1: Register for the Text SSS Service

To register, text the following to 2600:

SSS REG <SS Number> <Date of birth in mm/dd/yyyy format>

Once successfully registered, you'll receive a unique system-generated PIN that you'll use for all inquiries to the Text SSS facility.

Step 2: Use the Text SSS Service to Check Contributions

To check your SSS monthly contributions via SMS, simply type the following and send it to 2600:

SSS CONTRIB <SSS NUMBER> <PIN>

How to Check SSS Contributions Online: FAQs

1. How much was the SSS contribution increase in 2023?

From the current 13%, the contribution rate increased to 14% in 2023. Employers shoulder the 1% increase, and the 4.5% is deducted from the employee. SSS is mandated to gradually increase the contribution rate by one percentage point every two years until it reaches 15% by 2025.[4]

2. How do I check SSS contributions online without registration?

To check your SSS contributions online, you’ll need to register for an account first. Go to member.sss.gov.ph, click the Register button, and proceed with the web registration. Once you complete your registration, you can check your SSS contributions.

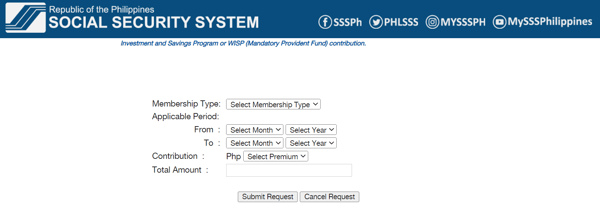

3. How do I pay SSS contributions using the SSS Mobile App?

If you're an OFW or Voluntary SSS member, you can log in to the SSS Mobile App and generate a Personal Reference Number (PRN). This will allow you to pay for your monthly contribution using your preferred payment method. Just tap on Generate PRN, select the membership type and the applicable period, and tap Submit.

4. Can I change or update my SSS contribution online?

Yes. Voluntary members and OFWs can change or update their monthly contributions via the SSS Member Portal.

On the Member Portal homepage, hover on the Payment Reference Number (PRN) - Contributions tab, then click Generate PRN.

5. What happens if my contributions weren’t paid?

Employer failure to pay SSS contributions is punishable with a fine of not less than ₱5,000 and not more than ₱20,000 or imprisonment for six to 12 years at the court's discretion.[3]

If you’ve already talked to your employer or the HR department and still no actions were made, you can file a complaint at any SSS branch.

6. What should I do if my latest SSS contribution hasn’t been posted yet?

If you’re employed, follow up with your HR department. Alternatively, you can log in to your SSS account and check your notifications (look for the envelope icon in the upper right corner). You’ll see your most recent SSS transactions, including your contribution payments for which period and the amount.

Self-employed and voluntary members may have to wait three days before payments are posted. If your payment hasn't been posted after a month, you may email PRNHelpLine@sss.gov.ph.

7. Can I still pay for missed SSS contributions?

The SSS doesn’t allow retroactive payments.

You’ll still be entitled to SSS benefits even if you miss a monthly contribution. However, note that certain benefits require a number of contributions before a contingency for members to be eligible.

8. I lost my job. How can I continue paying my SSS contribution?

You’ll be recategorized as a self-employed or voluntary member. Just log in to your My.SSS account and generate a Payment Reference Number to pay for your contributions.

You can also set your preferred monthly contribution. Submit a request to the SSS via the portal, and you’ll be notified once you can begin paying your contributions again.

Final Thoughts

If you know how to check SSS contributions online, you can keep track of your payments and correct any errors in your contributions. This will save you from paying penalties and getting disqualified for a specific claim.

Once you're done checking your SSS contributions online, make sure to log out properly. Clear your browser history to protect your account from online fraud, especially when you use a computer in an internet cafe or connect to a public Wi-Fi network.

Sources:

- [1] Summary of SSS Benefits

- [2] SSS and You: A Membership Primer

- [3] SSS issues 923 show cause orders to business employers in nationwide RACE Ops (SSS, 2023)

- [4] SSS to proceed with contribution rate hike (The Philippine Star, 2023)