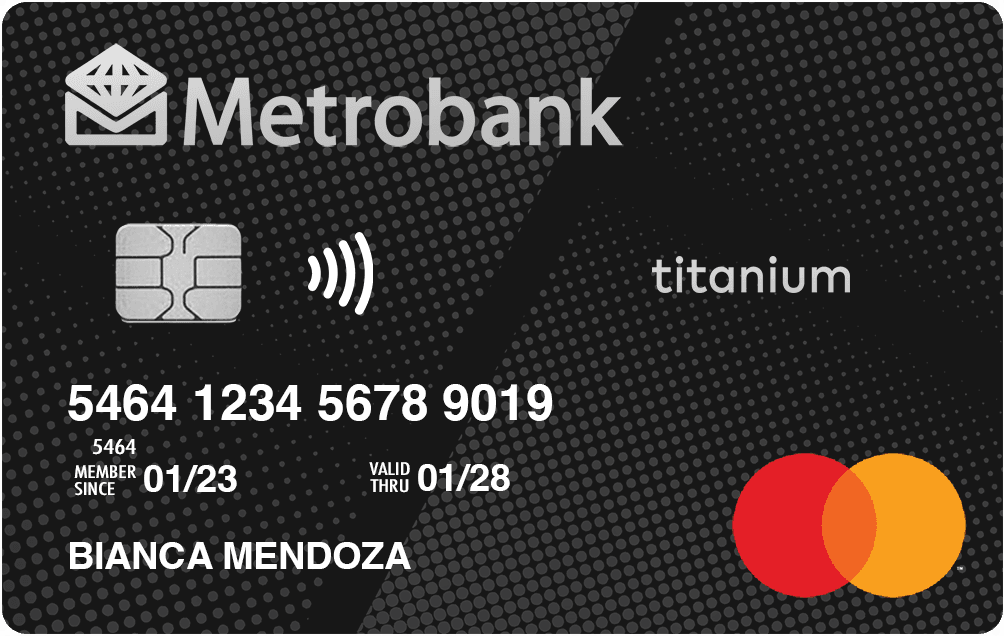

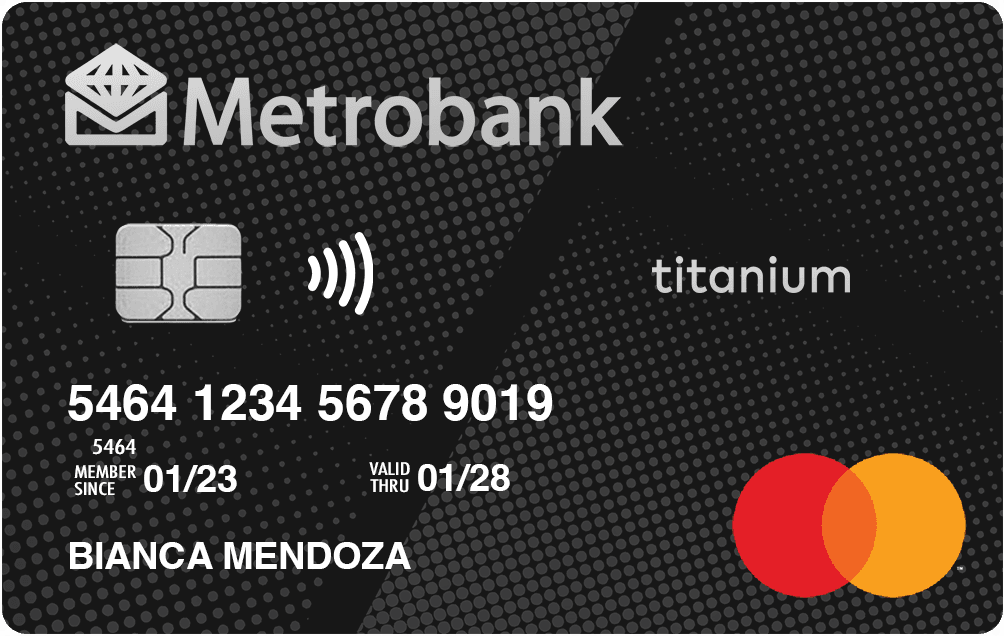

Metrobank Titanium Mastercard®

Shopping for essentials doesn’t have to be hard. Do it with the Metrobank Titanium Mastercard®. Earn 2x rewards points on dining, department store, and online expenses and one (1) point for every ₱20 spend on all other categories. Shop for essentials the smart way by applying today.

info

info

info

info

info

layers

Highlights

info

info

info

info

info

Offer Available

No Minimum Spend Required!

₱3,000 eGift

+ 2 other gift options

Promo runs until October 15, 2025. Per DTI Fair Trade Permit No. FTEB-235058. Series of 2025. T&Cs apply. Disclaimer: For higher chances of approval, applicant must be a principal cardholder of a credit card issued by a traditional bank for at least 6 months.

chevron_left

chevron_right

Things to consider when choosing this card:

Things to consider

check

No annual fee

check

Dining points

check

Free reward points

sentiment_satisfied

Benefits

Rewards

redeem

Rewards - Base Rate

info

shoppingmode

Rewards - Overseas Spend

info

dining

Rewards - Dining Spend

info

barcode_reader

Rewards - Department Store Spend

info

sports_score

Quick Facts

check_circle

Earn 2x rewards points on dining, department store, and online purchases

check_circle

Earn one (1) point for every ₱20 spend

check_circle

Enjoy exclusive credit card features from Metrobank

check_circle

Ideal for: money-savvy cardholders shopping for essentials

rule_folder

Eligibility

Eligibility Criteria

info

Regular Employee

- Government-issued ID: Should contain your date of birth and a visible signature

- Proof of income: For applicants without credit cards from other banks: copy of the latest ITR duly stamped as received by the BIR or bank/copy of BIR Form 2316 signed by employer, or copy of last 3 months' payslip.

Self-Employed

- Government-issued ID: Should contain your date of birth and a visible signature.

- Proof of income: For applicants without credit cards from other banks: copy of the latest ITR duly stamped as received by the BIR or AFS with BIR or bank stamp.

local_atm

Fees / Repayment

Fees & Charges

info

info

info

Tags

Metrobank Titanium Mastercard®

Metrobank Titanium Mastercard®

close

Gift Options

; or