In this technologically advanced era, it's hard to imagine life without a PayPal account. Signing up on PayPal is like a rite of passage to adulthood—it allows you to perform financial transactions over the internet, like shopping online, sending money, and receiving payments.

While PayPal helps make online transactions a lot easier, faster, and safer, it can seem complicated and overwhelming for first-time users. This is why we've come up with this comprehensive guide on how to use PayPal in the Philippines.

How to Create a PayPal Account

It's free to sign up on PayPal. No registration fee is involved. All you need to make a PayPal account in the Philippines are your computer or smartphone and an internet connection. Below are the steps to help you begin.

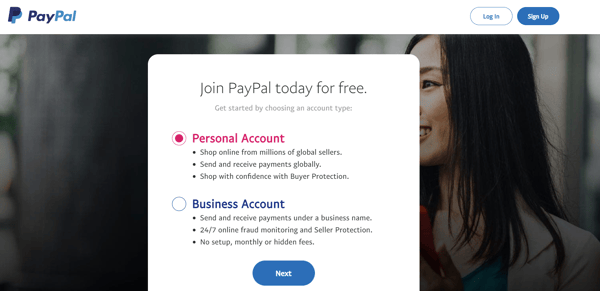

1. Choose Your PayPal Account Type

PayPal offers two types of account with features catering to different needs: personal and business. Before you register with PayPal, it's important to decide on the type of account to set up.

PayPal Account for Personal Use

A personal PayPal account is suitable for the following users:

- Individuals who shop and pay online

- People who send and/or receive money from family and friends

- Casual sellers or non-businesses that buy and sell online

PayPal Account for Business Use

You need a business account on PayPal if you're running an online business registered under a company name. A business account allows your business to accept PayPal as a payment method, helping you attract more customers who prefer to pay for their purchases via PayPal.

Freelancers receiving payments from their clients can also benefit from having a business account with PayPal. With a PayPal business account, you can:

- Accept payments via debit card, credit card, and bank account from buyers

- Assign and manage access rights to the business account for up to 200 employees

- Use a customer service email alias for faster resolution of customer issues

How to Create a Personal PayPal Account

- Go to the Sign Up page[1] on the PayPal app or website.

- Tick the "Personal Account" option. Click the Next button.

- From the dropdown menu, choose from Online Shopper, Individual Seller/Freelancer, Both of the Above, or I'm Not Sure. Click the Next Button.

- Add your mobile number, and then click Next.

- Confirm your phone number by entering the security code sent to your mobile number.

- Next, set up your profile by entering your email address, full name, and password. Confirm your password, and then click Next.

- Choose your nationality and ID type, enter your date of birth, ID number, and address, making sure that every detail matches that in your valid ID or your proof of billing.

- Accept PayPal's terms and conditions by ticking the small box at the bottom of the form.

- Click the Agree and Create Account button. Confirm your email address.

- To start using your PayPal personal account, add a credit or debit card to your account.

How to Create a Business PayPal Account

- Go to the Sign Up page on the PayPal app or website.

- Select the "Business Account" option. Click the Next button.

- Enter the email address you'll use to register and sign in, and then click the Continue button.

- Set a password. Click the Continue button.

- Enter your business information, such as business contact (your legal first and last name), business details (legal business name that your customers will see), business phone number, and business address.

- Choose the primary currency (Philippine Peso).

- Tick the box with PayPal's terms and conditions, and then click "Agree and Continue".

- After you confirm your email address and other business relevant business information, link your PayPal business account to a bank account, and you’re good to go.

PayPal Requirements for Sending and Receiving Money

PayPal is so easy to use that you don't need to submit any forms or documents (unless you'll be making high volumes of transactions) to start sending or receiving money. Here's how to use PayPal Philippines for receiving and sending money:

How to receive money on PayPal: Provide the person who'll send you money with the email address you're using in PayPal. Make sure you've confirmed your email address after signing up for an account.

How to send money using PayPal: You need to have a confirmed email address on your PayPal account. You should also link a credit or debit card to your account, so you can start making a PayPal money transfer.

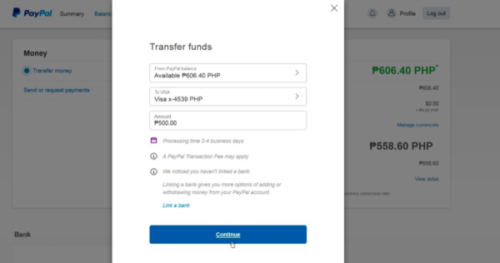

How to Deposit Money to Your PayPal Philippines Account

Shopping abroad? Or maybe you need to send money to someone who also has a PayPal account? Here's how to add money in PayPal Philippines:

- Click Add Money below your PayPal balance.

- Select your bank account (if you have more than one).

- Enter the amount to transfer and click Add.

- Review the transfer details and click Submit.

However, take note that you can only do this if you have confirmed your bank account with PayPal. To do so, check out the steps to link PayPal to bank account below.

The funds should appear in your PayPal balance within 3 to 5 business days. Also, the bank account must be in the same name as your PayPal account.

Can I add money to PayPal without a bank account in the Philippines?

Unfortunately, you can't. As of writing, the only way to deposit money to PayPal Philippines is via a linked bank account.

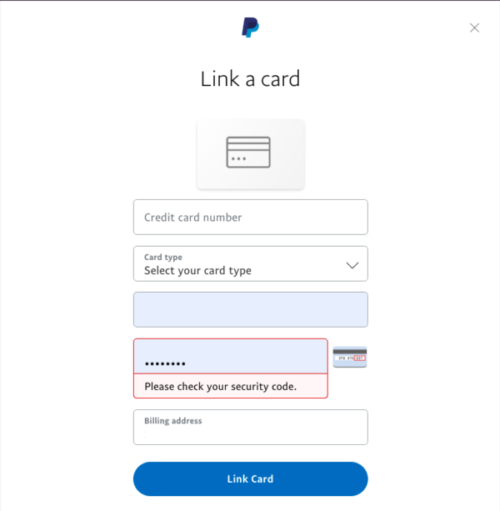

How to Link PayPal to Bank Account, Debit Card, or Credit Card

Linking your credit card or debit card to your PayPal account is a crucial step you shouldn't skip. Once you've added your cards to your account, you can start using PayPal conveniently and safely for making online payments and money transfers.

PayPal to Credit Card

- Log in to your PayPal account.

- Under "Wallet" click the "Link a Card" option.

- Enter your credit or debit card details.

- Click the Link Card button.

- Upon successful linking, you'll now see your card under the Wallet tab.

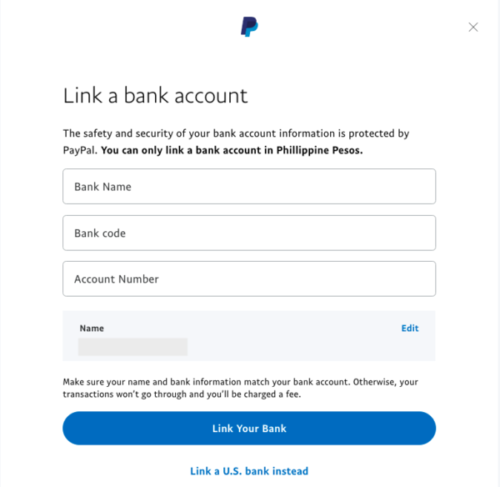

PayPal to Bank Account

- Log in to your PayPal account.

- Under "Wallet", click "Link a Bank".

- Enter your bank name, nine-digit bank code, and savings/checking account number.

- Click the Link Your Bank button.

How to Send Money Using PayPal Philippines

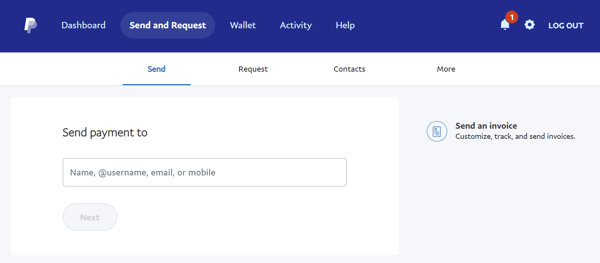

How to Pay Someone Using PayPal

PayPal makes it quick and easy to send money to another PayPal account holder with an email address or mobile number. Here's how to use PayPal for sending money:

- Log in to your PayPal account.

- On the top menu, click "Send & Request."

- Enter the recipient’s email address. Click the Next button.

- Type the amount you'll send and select the currency. Optional: You can add a note to the recipient under 'What's this payment for?'.

- Click the Continue button.

- Select your preferred funding source for the PayPal money transfer (either from your PayPal Balance or any of your linked credit or debit cards).

- Review the details and click the Send Payments Now button.

Your recipient will then receive an email notification from PayPal that they have received money on their PayPal account. If the recipient doesn't have an account yet, they'll be instructed on how to create one. You'll also receive a transaction receipt in your own PayPal email.

How to Pay Online Purchases via PayPal

Making payments for goods or services purchased online is also possible on PayPal. The process is quite similar to sending money to family and friends. Here's how to use PayPal for online shopping:

- Log in to your PayPal account.

- On the top menu, click "Send & Request."

- Enter the recipient’s email address. Click the Next button.

- Type the amount you'll send and select the currency. Optional: You can add a note to the recipient.

- Click the Continue button.

- Select "Paying for an item or service."

- Select your preferred funding source for the PayPal money transfer (either from your PayPal Balance or any of your linked credit or debit cards). Click the Next button.

- Review the details and click the Send Payments Now button.

The seller who'll receive your payment will be the one shouldering the PayPal fee.

How to Transfer Money Using PayPal Philippines

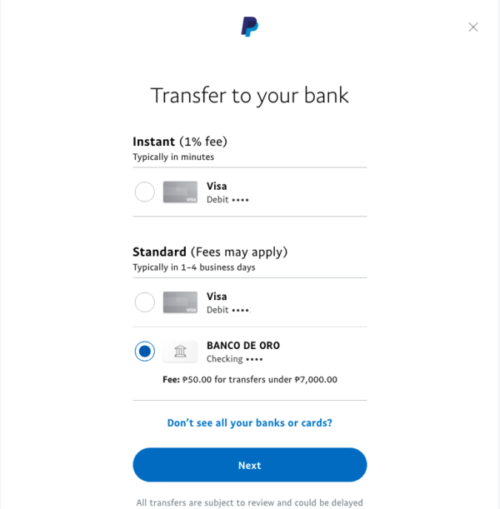

PayPal to BPI or any Bank Account

The traditional way to cash out PayPal balance is to do a PayPal to bank account transfer (savings or checking account). It's the slowest and most expensive PayPal money transfer method, but it's your only choice if you have no digital wallet like GCash and Coins.ph.

Here's how to transfer money from PayPal to BPI or any bank account in the Philippines:

- Log in to your PayPal account.

- Below your PayPal balance, click the Transfer Funds button.

- Choose the bank account where you'll transfer your PayPal balance. Click the Next button.

- Enter the amount to transfer. Click the Next button.

- Review your withdrawal details. Click on "Transfer."

PayPal to GCash

Transferring your PayPal balance to your GCash account is a money-saving option because no withdrawal fee is charged. This makes withdrawing with GCash a great idea for freelancers, small business owners, and anyone who regularly receives money on their PayPal account.

How to transfer money from PayPal to GCash? First, you need to link your PayPal account to your GCash account. Below are the steps for a PayPal to GCash transfer:

How to Link PayPal to GCash

- Log in to your GCash account.

- Tap “Link PayPal Account” on the side menu.

- Enter your confirmed email address with PayPal.

- You'll be taken to the PayPal login page. Log in to your PayPal account.

- Tap "Authorize" to send money from your PayPal to GCash.

How to Withdraw PayPal Balance Using GCash

- Go to your GCash app dashboard and tap “Cash-In.”

- Tap "PayPal to GCash."

- Enter the amount you wish to transfer and choose the currency. Tap "Next."

- Review the amount and tap "Confirm."

- Wait for a text message from GCash confirming your successful transaction.

Read more: How to Use GCash: A Handy Guide for New GCash App Users This 2022

PayPal to Coins.ph

Unlike with GCash, there's no way to directly transfer PayPal balance to a Coins.ph account. However, you can still make a PayPal to Coins.ph transfer through GCash. Here's how:

- Log in to your GCash account.

- Transfer your PayPal balance to the GCash account (See the step-by-step guide in the previous section).

- Log in to your Coins.ph account.

- Select GCash as your cash-in method.

- Enter the amount to transfer.

- Tap "Done."

Note that GCash charges a ₱15 transaction fee for funds transfer to Coins.ph. Then Coins.ph will also charge you a ₱10 fee for cashing in from GCash.

PayPal to PayMaya (Now Maya)

Maya (formerly PayMaya) is another cheap and quick option for withdrawing your PayPal balance. You can transfer a minimum of ₱500.

To do so, you should have at least ₱100 in your Maya wallet and link your Maya and PayPal accounts (Refer to "How to Link a Credit Card to PayPal" in the previous section).

After linking your Maya and PayPal accounts, you can start transferring your PayPal balance to your Maya account.

- Log in to your PayPal account.

- Click on "Transfer Funds."

- Choose your Maya account. Click the Next button.

- Enter the amount to transfer. Click the Next button.

- Confirm your transaction.

How Long Does It Take to Receive PayPal Money?

How soon you'll receive your PayPal funds depends on where you transferred your money. For instance, if you want to know the PayPal to BPI transfer time, it can be instantly, within the day, or up to four banking days. Typically, money transfers get completed faster using a mobile wallet than a bank account.

For first-time PayPal to bank transfers, PayPal may temporarily hold the funds received in the bank account for several reasons[2].

At a glance, here's a table showing how long you can expect to receive money using different PayPal fund transfer methods.

| Recipient Account | Processing Time |

|---|---|

| Bank Account | Instant - within minutes |

| Standard - 1 to 4 business days | |

| GCash | Within 24 hours |

| Coins.ph (via GCash) | Within 24 hours |

| PayMaya | 2 to 4 business days |

Back to the main article: [Battle of the Brands] PayMaya vs GCash: Which Mobile Wallet App is Right for You?

What are the PayPal Fees?

Certain PayPal transactions come with a fee, which is deducted from the transferred amount. But there's no PayPal to PayPal transfer fee in the Philippines because it's the recipient will cover the fees. If it's an overseas payment in a different currency, there will be fees.

Here are the PayPal fees in the Philippines you must know:

| PayPal Transaction | PayPal Fee |

|---|---|

| Sending payment | None |

| Receiving payment for goods and services (international) | 4.4% of the paid amount + ₱15 |

| Receiving payment for goods and services (domestic) | 3.9% of the paid amount + ₱15 |

| Withdrawal via bank account | Withdrawing ₱7,000 and above - None Withdrawing less than ₱7,000 -₱50 |

| Standard withdrawal via Visa debit card | ₱50 regardless of the withdrawn amount |

| Instant withdrawal via Visa debit card | 1% of the withdrawn amount |

| Returning of funds to PayPal account due to incomplete or incorrect information in the withdrawal request | ₱250 |

Final Thoughts

Using your PayPal account may be confusing and frustrating at first, but it will get smoother as you get the hang of it. Just remember to double-check your transaction details every time, so you won't encounter issues in your PayPal money transfer or payment. Hope this guide on how to use PayPal Philippines has helped you out!

Sources:

- [1] PayPal Sign Up page

- [2] "Funds Availability: How Does It Work?" (PayPal Philippines website)