Saving money is as easy as spending it—said no one ever. This is probably why Filipinos constantly try to find fun and creative ways to save, even coming up with their own ipon challenges.

With a money-saving challenge, you take one step toward achieving your financial goal—be it saving for a trip abroad, planning a destination wedding, making a down payment for a home or car purchase, or raising capital for a small business. You also develop financial discipline through the habit of saving.

Seems like a tall order, huh? But as Jhoemel Relucio and Ginalyn Ansus proved, it's possible. This couple from Albay created their own ipon challenge by sticking ₱100 bills to their calendar, saving around ₱73,000 by the end of the year.[1]

Take a look at these 2023 ipon challenges and pick one that suits you best.

What is an Ipon Challenge?

An ipon challenge is a strategy that involves sticking to a money-saving activity for the entire year. Ipon challenges are done regularly, deliberately, and strategically, helping you stay on track with your savings target and financial goals.

7 Ipon Challenges to Try in 2023

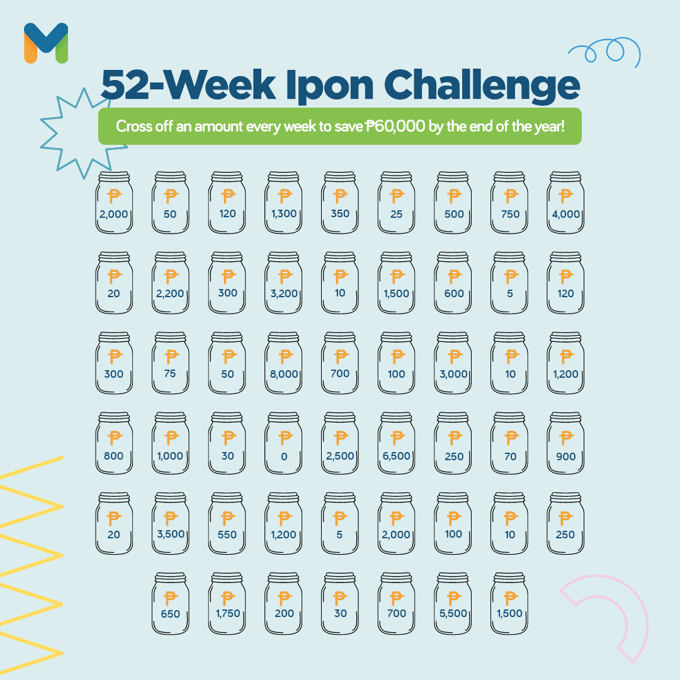

💸 52-Week Ipon Challenge

How much you can save in a year: ₱1,378 to ₱137,800

The 52-week ipon challenge involves saving in increments weekly, starting from the first week of the year until the last. This ipon challenge is popular among Filipinos for a good reason—it’s flexible, so you can start small this week, then go big the following week. It all depends on how much you can afford to save every week.

How to do it: Use Moneymax's printable ipon challenge chart above to save as much as ₱60,000 a year. Click on the image and save it on your phone or computer, or print out a copy, so you won't forget your weekly challenge. Pick an amount to save each week, then cross it off. You can always save more if you wish!

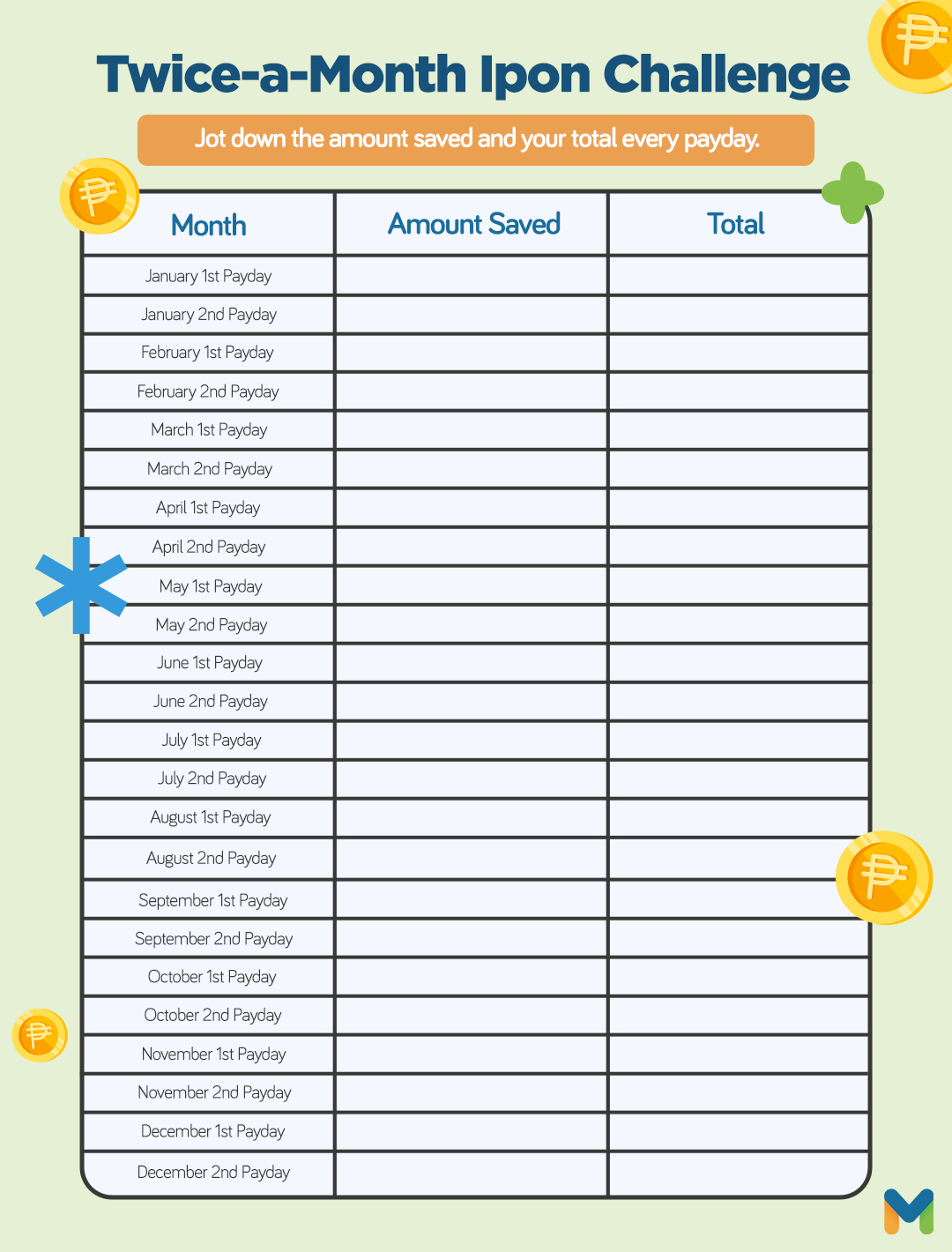

💸 Twice-a-Month Ipon Challenge

How much you can save in a year: ₱15,000 to ₱150,000

If saving every week sounds more like a burden rather than a fun and encouraging activity, then you might want to try this bi-monthly ipon challenge. It’s easier to follow than the 52-week money challenge because you part with your money less often (24 weeks versus 52 weeks).

How to do it: The twice-a-month saving challenge entails saving in increments of ₱50 to ₱500 every payday. Pick an increment you're comfortable with then write down the amount and the total amount saved. Saving every payday is more convenient, so it's definitely one of the easiest ipon challenges to try.

💸 12-Month Ipon Challenge

-Jan-06-2023-10-55-19-9345-AM.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(4)-Jan-06-2023-10-55-19-9345-AM.png)

How much you can save in a year: Depends on your monthly income

Personal finance coach Alvin Tabañag's income-based ipon challenge[2] is a more sustainable alternative to the 52-week money challenge since it takes one’s monthly income into account.

How to do it: To start, set a base amount that you can commit to saving every month—it can even be zero if you don’t earn much—and add it to a percentage of your monthly salary, beginning with 1% in January, that increases in increments of 1% until you reach 12% by December. Confused? Check out the ipon challenge template below:

Monthly savings = Base amount + [Month % x Monthly income]

For example, you’re earning ₱20,000 per month, and you set your base amount to 0. In January, your total savings should be (0 + [1% x 20,000]) = ₱200. In February, it will be (0 + [12% x 20,000]) = ₱400. Continue until you finish your money-saving challenge in December.

💸 365-Day Ipon Challenge

-Jan-06-2023-10-56-57-1654-AM.png?width=600&height=400&name=Pics%20for%20blog%20-%20600x400%20(6)-Jan-06-2023-10-56-57-1654-AM.png)

How much you can save in a year: Depends on how much you can save daily

If the ipon challenges listed above look too complicated for you, a simpler approach to saving is to stash away a fixed amount every day. No need to remember numbers and make complex calculations. Just set an alarm on your mobile phone to remind yourself to set aside some coins or bills every day.

How to do it: Just set aside what you can afford to save daily. It can be as small as ₱10 (which gives you approximately ₱3,650 by December) or ₱100 (for a total of around ₱36,500).

Related article: What Would You Do with an Extra ₱5,000?

💸 200-Day Ipon Challenge

@maypresidente 145 pesos for Day 1. 02.10.22 #200daysiponchallenge #fypシ ♬ original sound - Nina Dizon - Mima

How much you can save in a year: ₱20,100

If you're a TikTok mainstay, you've probably seen the trending 200-day ipon challenge. It's not as demanding as a daily challenge, so you can afford to miss a day or two every so often. Just make sure to finish the challenge by the end of the year to complete the 200-day ipon challenge total, which amounts to ₱20,100.

How to do it: Write down the numbers 1 to 200 on individual pieces of paper, roll them up, and place them in a jar. For 200 days, pick out a piece of paper and save the specified amount. The element of mystery adds to the fun, don't you think?

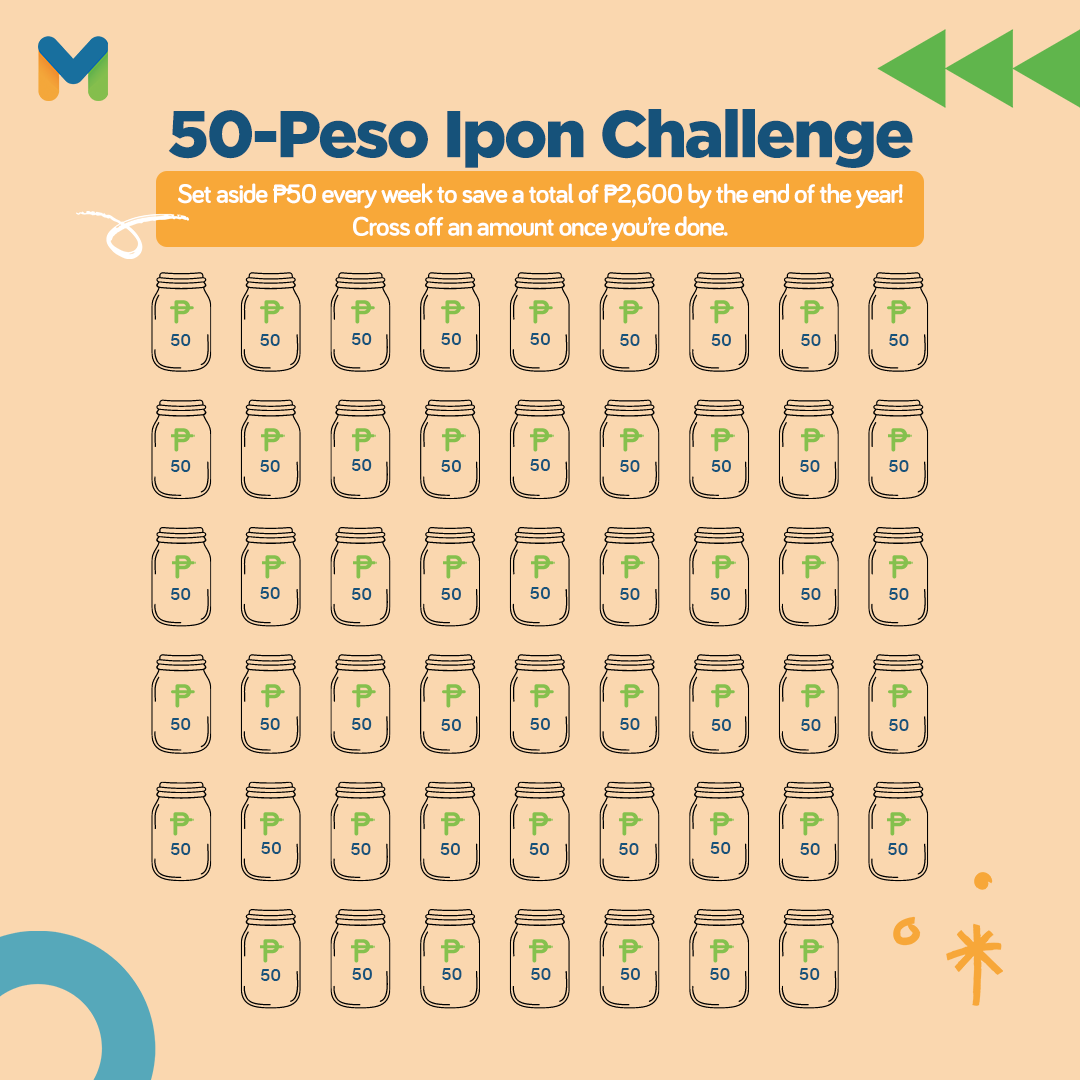

💸 50-Peso Ipon Challenge

How much you can save in a year: At least ₱2,600 if you do it once a week or ₱18,250 if you save daily

How to do it: Commit to putting a ₱50 bill in your alkansya every week or day. This will make saving money a natural habit for you.

If you want to maximize your savings, you can put away all your ₱50 bills each time you get them, like when you receive change. You’ll be surprised at the total savings you’ll get by the end of the year.

💸 Loose Change Ipon Challenge

How much you can save in a year: Depends on how many coins you can collect during the whole year

How to do it: How about putting in a jar every spare change you receive and coins scattered around your home? The loose change challenge won’t accumulate as much money as the other ipon challenges, but it will definitely motivate you to save. Encourage your kids to try this easy money-saving challenge as well!

Final Thoughts

Before you say “Challenge accepted,” decide which method you think is doable. Feel free to adjust your savings amount according to what your budget allows. After all, these ipon challenges are simply a way to train yourself to save.

If you're always on your phone, you can also check out ipon challenge apps such as My Ipon Challenge: Piggy Bank[3] or Ipon: 52 Weeks Money Challenge.[4]

Make sure to protect your money. Put your savings in a secure place, whether it’s the old-fashioned alkansya or an interest-earning bank account. When you reach your savings goal by the end of the year, put your money in investment vehicles that earn higher interest rates than traditional bank accounts.

Source:

- [1] Mag-live in partner, nakaipon ng P73K sa kalendaryong nagmistulang 'alkansiya' (GMA Network, 2023)

- [2] The 12-month saving challenge (Rappler, 2015)

- [3] My Ipon Challenge: Piggy Bank - App Store | Play Store

- [4] Ipon: 52 Weeks Money Challenge - Play Store

%201200x350%20CTA-1.png?width=751&height=219&name=UB%20PL%20Generic%20Ad%20(Sep%202023)%201200x350%20CTA-1.png)