Who says owning a credit card has to be boring? In this UnionBank PlayEveryday review, you'll learn that you can make a game out of using a credit card for all your daily transactions. Plus, you earn points for every accomplishment in this "game"!

Read on to know how UnionBank PlayEveryday makes every credit card experience fun and rewarding.

UnionBank PlayEveryday Credit Card: Key Features

To start this UnionBank PlayEveryday review, let's check out the key features of this credit card:

- Annual fee: ₱1,500

- Interest rate: 3%

- Minimum monthly income requirement: ₱30,000

- Cash advance fee: ₱200 per cash advance and 1.96% finance charge per month until date of repayment

- Late payment fee: ₱1,000

- Overlimit fee: ₱500

- Card replacement fee: ₱400

Read more: How to Apply for a UnionBank Credit Card: 3 Easy Steps to Follow

UnionBank PlayEveryday Credit Card Review: Why Should I Get This Card?

What sets apart the UnionBank PlayEveryday credit card is its focus on gamified credit card transactions. To find out more, let's explore its rewards system.

👉 Exciting Play Points System

The UnionBank PlayEveryday prides itself on having the first gamified banking rewards program in the Philippines. For starters, you earn 1 Play Point for every ₱10 spend, one of the lowest point conversion rates out there.

To earn points, use the UnionBank PlayEveryday Credit Card to pay for your daily transactions. The more you spend, the more points you earn.

Here are other ways to earn points:

| Ways to Collect Points | Play Points to be Earned |

|---|---|

| Visa spend worth ₱10 | 1 point |

| Set up your PlayEveryday profile |

500 points |

| Set up your 2nd PlayEveryday card |

500 points |

| Referral | 300 points |

| First request for payment | 50 points |

| First split bill | 50 points |

| First scan QR code | 50 points |

| First 3 bills payments | 100 points |

| Reach 100% of your goal | 300 points |

| Reach 50% of your goal | 100 points |

Use the UnionBank Online app[1] to accomplish other point-earning activities, track your points, and redeem rewards.

👉 PlayEveryday Levels and Bonus Points

Of course, it won't be a game without levels, and that's exactly what the UnionBank PlayEveryday has in spades.

If you've reached enough points, you can reach a corresponding level. Leveling up also earns you extra Play Points, so the higher your level is, the higher your bonus will be.

| Rank | Rank Point Requirement | Bonus Points |

|---|---|---|

| Rookie | Default | – |

| Rising Star | 2,000 | 300 |

| Celebrity | 5,000 | 1,000 |

| All Star | 10,000 | 2,000 |

| Superstar | 20,000 | 5,000 |

| Hall of Famer | 40,000 | Unlock Special Feature 1 |

| Hall of Famer 2 | 64,000 | Unlock Special Feature 2 |

| Hall of Famer 3 | 94,000 | Unlock Special Feature 3 |

Note that your rank won't decrease even if you redeem some of your points. For example, if you're an All Star and want to redeem a reward, you'll still remain an All Star even if you currently don't have 10,000 points. However, it can decrease due to a reversal of transactions.

👉 PlayEveryday Weekly Leaderboards

You can track your level within the UnionBank Online app. For extra bragging rights, your profile will be included in the PlayEveryday Leaderboard. Do you have what it takes to top these weekly leaderboards?

| Leaderboard | Description |

|---|---|

| Top Card Usage | Most points collected from transactions made through PlayEveryday Credit Card |

| Top Points Collectors | Most overall points collected from all points-earning transactions |

| Top Savers | Most goals set in UnionBank Online |

| Top Big Goal Achievers | Most points collected from reaching 50% and 100% of Goals in UnionBank Online |

Ready to get the UnionBank PlayEveryday card? Here's a quick rundown of its key features:

What Other Perks Can I Get With My UnionBank PlayEveryday?

-Oct-16-2023-02-40-12-1589-AM.png?width=675&height=450&name=Pics%20for%20blog%20-%20600x400%20(1)-Oct-16-2023-02-40-12-1589-AM.png)

If the gamification of credit card transactions piqued your interest, then these UnionBank PlayEveryday perks will further convince you to get this card.

👉 Robust Rewards Program

What's the use of having so many Play Points without a proper rewards program to back it up? Use your points to redeem e-vouchers from hundreds of stores nationwide, cash rebates, or annual fee waivers.

👉 Easy-to-Use UnionBank Online App

Getting the UnionBank PlayEveryday means getting to experience the joys of using the UnionBank Online app, one of the best banking apps out there.[2] From the app itself, you can track your Play Points, monitor your transactions, redeem rewards, pay bills, split expenses with your friends, and access exclusive UnionBank promos.

UnionBank PlayEveryday Alternatives

This UnionBank PlayEveryday review won't be complete without presenting possible alternatives. Because let's face it—not everyone enjoys playing games, especially when it comes to their finances.

First, check out UnionBank's other cards:

|

Credit Card

|

Annual Fee

|

Minimum Annual Income Requirement

|

Key Features

|

|

UnionBank Rewards Credit Card

|

₱2,500

|

₱180,000

|

|

|

UnionBank PlayEveryday

|

₱1,500

|

₱360,000

|

Gamified rewards system:

|

|

UnionBank Lazada Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Go Rewards Gold Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Cebu Pacific Gold Credit Card

|

₱3,000

|

₱360,000

|

|

|

UnionBank Platinum Visa Card

|

₱3,000

|

₱600,000

|

|

|

UnionBank Cash Back Platinum Visa

|

₱4,500

|

₱180,000

|

|

See more below:

💳 UnionBank Rewards Credit Card

Looking for another rewarding credit card from UnionBank? Use the UnionBank Rewards Credit Card to earn 1 point for every ₱30 spend. Triple your points when you use your UB Rewards card at shopping boutiques, department stores, and restaurants.

🎁 Free Gift from Moneymax: Giftaway Cash Credits, Apple AirPods 2, or Samsung Galaxy Buds FE

Eligible card: Any UnionBank credit card

Promo period: Until May 31, 2024

Get a pair of Apple AirPods 2 worth ₱8,490, Samsung Galaxy Buds FE worth ₱5,490, or Giftaway cash credits worth ₱4,000! Just apply for any UnionBank credit card via Moneymax, get approved within the promo period, and then meet the ₱10,000 spend requirement within 60 days from your card approval date.

This Moneymax UnionBank welcome gift promo runs until May 31, 2024 only. Per DTI Fair Trade Permit No. FTEB-192101 Series of 2024. Terms and conditions apply.

Note: The promo is exclusive to carded applicants who do not have an existing principal credit card issued by UnionBank and/or Citi.

💳 Metrobank Titanium Mastercard®

The Metrobank Titanium Mastercard® also has a low points conversion at ₱20 per point. You can even double your points on dining, department store, and online purchases! Plus, you get access to Metrobank's roster of useful credit card tools and services.

Read more: Metrobank Credit Card Application: Eligibility, Requirements, and More

Want to earn even more points? Set your sights on the HSBC Red Mastercard. Get 4x reward points on online, shopping, dining, and overseas transactions. You can also earn up to a 6% rebate on Caltex fuel purchases!

Read more: A First-Timer’s 4-Step Guide to HSBC Credit Card Application

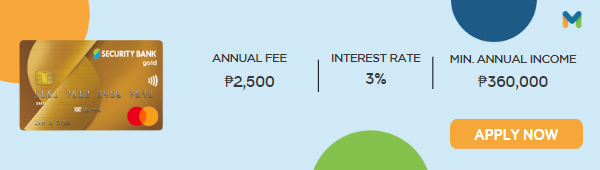

💳 Security Bank Gold Mastercard

The Security Bank Gold Mastercard earns 1 point for every ₱20 spend. You also get to enjoy exclusive rewards and promos all year round. If you're a frequent flyer, you'll be glad to know that you can use this card to access the Marhaba Lounge at NAIA Terminals 1 and 3.

Read more: How to Apply and Get Approved for a Security Bank Credit Card

With the BPI Rewards Card, you earn 1 rewards point for every ₱35 spend and enjoy a variety of year-round discounts and perks. For bigger purchases, avail of flexible installment plans with terms of up to 36 months.

Read more: BPI Credit Card Application: Requirements, Process, and More

Final Thoughts

That's it for our UnionBank PlayEveryday review! The bottom line is that this card is perfect if you want a fun and competitive credit card experience. Plus, you get to earn points, which you can then exchange for gifts and rewards of your choice.

Sources:

- [1] UnionBank Online App - App Store | Play Store

- [2] UNIONBANK: BLAZING DIGITAL TRAILS IN THE PHILIPPINES AND BEYOND (International Banker, 2023)

.png?width=600&height=170&name=UnionBank%20PlayEveryday%20(1).png)

-4.png?width=734&height=214&name=image%20(4)-4.png)