It’s easy to declare that you’re going to be more financially responsible from now on. But once you start going down the right path, you’ll find out that it’s not as easy as it sounds. In a country like the Philippines, money isn’t as easy as working hard. Sometimes, you have to keep reminding yourself with small nuggets of money-saving tips.

And luckily, that’s exactly what we did. We made a list of formidable financial hacks that can help inspire you to lead a healthier financial life, one step at a time.

Best Money-Saving Tips for Everyone

1. Make a budget for everything

You need to set financial limits for yourself to avoid overspending your money on a single purchase. Whether it’s your daily expense or a special occasion, don’t spend a single peso without following a certain budget[1].

2. Practice comparing prices

Whether it’s a pair of sunglasses or a car insurance policy, have more patience in comparing prices and searching for better alternatives. This will help you find better deals and prevent you from overspending.

3. Take care of your health

You’ll find it hard to save money if you are always sick. Unless you have a pre-existing condition, you should always keep yourself healthy. Eat right, exercise, and drink enough water for the day. Also, get vaccinated already! It’s literally free.

4. Build your emergency fund ASAP

While saving for the future is important, saving for the near future is equally as important. Your emergency fund will shoulder you from unexpected expenses like medical fees, car damage, house restorations, among others.

5. Add purpose to your saving goals

Saving money and saving for the future are two different things. To effectively save money, you should add a purpose to it. Save money for future use, like buying your first home, or funding your first car.

6. Find daily inspiration

Just like the slogan of that famous coffee commercial, reflect on why and who you are waking up in the morning for. Then take a sip of that coffee and start your day right. That should motivate you to continue living a frugal life.

Best Money-Saving Tips at Home

7. Buy energy-efficient appliances

Not only will it save money on electricity bills, it will also help lessen the harmful gases that affect the environment. Save the planet in your own small way by buying energy-efficient appliances.

8. DIY techniques can help you save

You can make gifts instead of buying them, cook meals instead of ordering out, or fix torn clothes instead of buying new ones. Aside from saving money, you’ll also acquire new skills for future reference.

9. Recycle your old and unused stuff

A list of money-saving tips won’t be complete without the constant reminder to reuse, reduce, and recycle. After you did a Marie Kondo on your closet, collect your junk and find new uses for said junk. Or better yet, sell your unused stuff online.

10. Rent out extra rooms for extra income

You can list your room on sites like Airbnb or rent it out on a monthly basis. That way, you can have someone to share the housing costs. Also, roommates!

11. Get rid of your cable and landline subscription

Of course, only if you’re not using it. Thanks to the internet and streaming services like Netflix, it becomes impractical to manage these subscriptions.

Best Money-Saving Tips Online

12. Enroll your bank accounts online

This will allow you to do digital banking transactions like paying bills and checking your balance straight from your smartphone or desktop. You’ll probably never have to leave your home again.

13. Open a digital bank account

Or better yet, open an account from any digital bank in the Philippines. Aside from their convenience, digital banks also offer high interest rates up to 6% so your savings could grow quicker.

14. Download money management apps

Aside from reading money-saving tips, you can also use money management apps to give you a better understanding of your spending habits. Recording all your impulse buys can be the ultimate guilt trip, convincing you to spend less.

15. Wait for online sales and discounts

Online stores like Lazada and Shopee usually host a lot of sales promotions and discounts so always keep your eyes peeled, especially if you’re buying something off-budget.

16. Turn off autofill features on your devices

This will make it harder for you to splurge online since you have to type your details one by one. Put your passwords instead on a locked note or download a password manager app.

Best Money-Saving Tips for Families

17. Educate your kids on saving money

Encourage everyone in the family to talk about money and teach your kids some of your best money-saving tips. That way, they’ll learn how to prioritize needs over wants at an early age.

18. Choose generic over branded medicine

Most medicines have generic brands that have the same effect if not better. Just like what the commercial says, don’t be shy to ask for the generic option.

19. Choose a fuel-efficient car

No matter how big the size of your family is, there is a fuel-efficient car that will provide you with a comfortable ride. So instead of focusing on the color, size, or model, consider a car’s fuel efficiency before starting your amortization.

20. Don’t be afraid to apply for a personal loan

...but only when the need arises. It can help you fund your daily expenses or an emergency that needs immediate funding. As long as you’re responsible in paying back your debt, a loan won’t make your financial woes worse.

Best Money-Saving Tips for Millennials

21. Get yourself a credit card

...but be responsible in using it. If you can’t afford to pay it in cash, never pay it with your credit card. It’s just that credit cards allow you to access discounts, promos, and other perks. They are more ideal for daily transactions compared to cash.

22. Follow the 48-Hour Rule

Whenever you’re about to make a big “want” purchase, sleep on it for two days. After that, decide whether you still want to buy it and that you’re ready for the consequences of buying it. That’s how you make an informed decision.

23. Minimize your food delivery spend

Instead, learn how to cook a proper meal. Not only will it save you money, you’ll also pick up a valuable life skill. You’re an adult stuck at home so use your time wisely.

24. Look for ways to earn extra income

There’s nothing wrong with living the hustle life. You can start setting up a business at home like loading stations, online buy and sell, home-cooked food delivery service, among others.

Read more: Your Guide to Maximizing Your Earning Potential on TikTok This 2022

Best Money-Saving Tips for Students

25. Open a bank account

Students nowadays can open their own savings accounts. All you need is a school ID and any other proof that you are currently a student. Start saving as early as now.

26. Avoid vices like smoking and drinking alcohol

Don’t give in to peer pressure and always be in control of your decisions. Developing vices can lead to not only financial problems but moral bankruptcy as well.

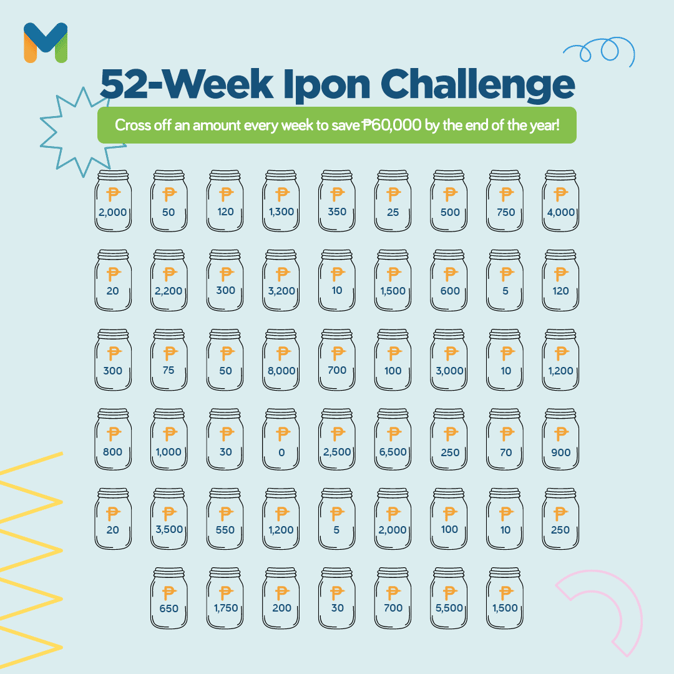

27. Join viral saving challenges online

Challenges like the 50-Peso Challenge or the 52-Week Money Challenge are fun ways to learn the importance of saving money. This will further develop your money-saving habits, plus you’ll get to be part of a trend.

28. Take advantage of student discounts

There are a lot of them that most students don’t know about. Use these government-mandated discounts to save money while also having fun.

Best Money-Saving Tips for Couples

29. Be more open when it comes to finances

Money is somehow a taboo topic for couples. You should be more open when it comes to financial matters. You don’t have to resent one another for having a higher salary or any other insecurities when it comes to money. Help each other to achieve your goals.

30. Invest your money on affordable investments

Because there’s two of you, your chances of gaining high returns are greater since you can help educate each other. You can either pull your resources together or explore different investment opportunities separately.

31. Keep separate bank accounts

You can of course discuss this with your partner, but having separate bank accounts can help organize your finances better. As they say, don’t put all your eggs in one basket.

32. Set a standard budget for date nights

Peg your night-out at a fixed amount for dinner, drinks, and travel. Even stay-at-home dates need budgeting for food deliveries and online streaming subscriptions.

Best Money-Saving Tips for Singles

33. Hang out with frugal and money-savvy people

Avoid toxic people and choose friends who are more frugal and money-savvy. This will inspire you to save more money, plus you’ll get to learn more money-saving tips from their experiences. Just don’t borrow money from them.

34. Read more personal finance books and blogs

Use your free time being single to learn more about how to improve your finances. The Moneymax blog is a great place to start.

35. Try exploring affordable hobbies

Reading and blogging is a good start, but try biking, cooking, baking, etc. It can help keep your mind out of a certain someone and you learn new skills at the same time.

36. Do not go to the grocery store hungry

You’ll be tempted to overspend on snacks instead of healthy and nutritious food. You’ll definitely find it hard to stay within your budget if you’re too hungry to care.

37. Find alternatives to retail therapy

Spending money won’t always cure the bad day you’re having. Learn how to pick yourself up without resorting to splurging. Why not head straight home and watch Modern Family? It’s their last season, you know[2].

Best Tips on Saving Money at Work

38. Choose to work from home

If the company allows it, choose to work from home. You’ll save a lot of money on transportation, food, and other daily overhead costs back when you were part of the daily grind at the office.

39. Learn more about your company’s benefits

Ask your HR representative about it and find out how you can maximize them. You might find benefits that will help you save a lot, especially in medical expenses.

40. Save your bonus and 13th month pay

Instead of spending it on lavish items or Christmas gifts, deposit them in your savings and emergency fund. Why not explore other investments as well? Or better yet, pay off your debts so you can make way for more savings.

Final Thoughts

There you have it, a collection of money-saving tips you can always use in your everyday lives. If you feel like the list wasn’t enough, feel free to explore more tips on saving money out there. After all, you will never stop learning and that’s totally fine. Keep going and keep growing your money until you live the life you deserve.

This article also appeared in The Manila Times.

Sources:

- [1] How to Make a Personal Budget in 6 Easy Steps (The Balance, 2019)

- [2] Retail Therapy: Does It Help? (Forbes, 2015)

_CTA_Banner.png?width=751&height=219&name=Singlife_Main_KV_(Sep_2023)_CTA_Banner.png)