Employers in the Philippines are expected to comply with laws that protect the rights of employees against unfair labor practices. Regardless of the nature of the business and the number of people hired, employers have a legal responsibility to provide their workers with government-mandated employee benefits under the Philippine Labor Code.

Whether you're a regular employee, a business employer, a household employer, or an HR practitioner, here are the critical things you need to know about government-mandated employee benefits in the Philippines.

Pag-IBIG, PhilHealth, and SSS: What are the Mandated Government Benefits in the Philippines?

Under the Labor Code of the Philippines,[1] employees are entitled to monetary benefits such as the minimum wage, 13th-month pay, and overtime pay, among many others.

In addition, the Labor Code also requires employers to become members of the Pag-IBIG Fund, PhilHealth, and SSS, as well as remit monthly contributions on behalf of their employees to these government offices. This ensures employees' access to mandated benefits from the government, such as affordable house financing, health insurance, and social security benefits.

Who Can Receive Government-Mandated Employee Benefits in the Philippines?

Government-mandated benefits from the Pag-IBIG, PhilHealth, and SSS cover the following workers:

- Permanent, temporary, or provisional employees (hired by private companies) under the age of 60 with a monthly income of more than ₱1,000

- Household workers with a monthly income of at least ₱1,000, including kasambahays, drivers, cooks, and gardeners.

- Filipinos working for Philippine-based or foreign-based employers and are working locally or overseas

- Foreigners not older than 60 years old who are living and working in the Philippines, except for those who are exempted under the country's totalization agreements

Pag-IBIG, PhilHealth, and SSS Employer Registration Guide

You need to register your business or company with the Pag-IBIG Fund, PhilHealth, and SSS to become an employer-member of these agencies. Only after doing so can you provide employee benefits mandated by the government.

When you register your business with the Department of Trade and Industry (DTI) through the Philippine Business Registry (PBR), you'll also get your Pag-IBIG, PhilHealth, and SSS Employer’s Registration Numbers.

But if you fail to register through the PBR, go to each of the government offices and submit your proof of business existence according to the type of your business:

- Micro-enterprise: Mayor's Permit or Barangay Certification

- Single proprietorship: Business Permit or Registration of Business Name from DTI

- Partnership or Philippine corporation: Articles of Partnership/Incorporation from the Securities and Exchange Commission

- Foreign-owned corporation: Articles of Incorporation and License to Transact Business in the Philippines

- Cooperative: Certificate of Registration from the Cooperative Development Authority[2]

📌 How to Register as a Business Employer with Pag-IBIG

Visit the Pag-IBIG branch that maintains your records and then submit the following requirements:

- Employer’s Data Form

- Specimen Signature Form

- SSS Certification (if you're registered with SSS already)

- Proof of business existence

📌 How to Register as a Business Employer with PhilHealth

Fill out and submit these documents to any PhilHealth office:

- Proof of business existence

- Two copies of Employer Data Record form (ER1)[3]

- Two copies of PhilHealth Membership Registration Form (PMRF) for each employee

📌 How to Register as a Business Employer with the SSS

Fill out and submit the Employer Registration (SSS Form R-1)[4] and Employment Report (SSS Form R-1A)[5] plus a photocopy of your proof of business existence to the nearest SSS office.

📌 How to Register as a Household Employer

Pag-IBIG, PhilHealth, and SSS have a unified registration process for household employers. If you hired a kasambahay, fill out and submit these documents to any branch of the three government offices:

- Household Employer Unified Registration Form

- Household Employment Unified Report Form (three copies)

- Kasambahay Unified Registration Form

- SSS Specimen Signature Card (SSS Form L-501)

- Pag-IBIG Specimen Signature Form

New Employee Registration with Pag-IBIG, PhilHealth, and SSS

Each time you hire an employee or household worker, you're responsible for updating Pag-IBIG, PhilHealth, and SSS about the new employment. This will ensure the accuracy of the employee's records, especially their contributions, with these government agencies.

📌 How to Register New Employees with Pag-IBIG

Ask your new employees to submit their Pag-IBIG Membership ID (MID) Number to you. Those without a MID number can register as Pag-IBIG members online.[6]

To report your new employees, simply add them to the Member's Contribution Remittance Form (MCRF) when remitting your company's monthly Pag-IBIG contribution. Under the last column ("REMARKS"), indicate "N" (new hire) and the hiring date in MM/DD/YY format.

📌 How to Register New Employees with PhilHealth

Submit these documents to the PhilHealth office where your business is registered:

- Accomplished PMRFs of new hires (whether they're PhilHealth members or not)

- Two copies of PhilHealth Report of Employee-Members form (ER2)

📌 How to Register New Employees with SSS

Ask your new employees to submit their SSS numbers to you. Require the non-SSS members to register at the SSS branch where your company is registered.

When you have the SSS numbers of all your new hires, fill out and submit an SSS Form R1-A to the branch where your company is registered. Alternatively, you can submit the form online via the My.SSS online facility. Before you can do that, you need to register for an SSS online employer account.

📌 How to Register Newly Hired Kasambahays

You can register your new kasambahay with Pag-IBIG, PhilHealth, and SSS through the Kasambahay Unified Registration, a one-stop shop online registration facility.

Government Contributions in the Philippines: Guide for Employees and Employers

Philippine labor laws require employers to deduct the monthly government contributions from their employees' salaries and pay both the employee and employer share of contributions to Pag-IBIG, PhilHealth, and SSS.

The remittances collected from the employee and employer contributions are what these three government agencies use to fund the mandatory benefits for employees.

How Much Should Employers and Employees Contribute?

Refer to the following tables to know how much the employee's and employer's share of contributions are for Pag-IBIG, PhilHealth, and SSS.

💸 Pag-IBIG Contribution Rates 2023

| Monthly Basic Salary | Employer Share | Employee Share |

|---|---|---|

| ₱1,500 and below | 2% | 1% |

| Over ₱1,500 | ₱100 | ₱100 |

The maximum monthly compensation used to compute an employee's Pag-IBIG contribution is ₱5,000. For employees earning higher than ₱5,000, the total contribution is ₱200—₱100 is deducted from their salary, and the employer remits the other ₱100.

Note: The Pag-IBIG Fund deferred the increase in members' contributions for 2023.[7] This means the ₱100 employee's and employer's share is still implemented, which remains unchanged since 1986.

The Pag-IBIG contribution hike, which will raise the employee share from ₱100 to ₱150, has been moved to January 2024.

💸 PhilHealth Premium Contribution Table 2023

| Monthly Basic Salary | Premium Rate | Monthly Premium |

|---|---|---|

| ₱10,000 and below | 4% | ₱400 |

| ₱10,001 to ₱79,999.99 | 4% | ₱400 to ₱3,200 |

| ₱80,000 and above | 4% | ₱3,200 |

Employers and employees equally share the monthly contributions to PhilHealth. The premium rate collection is currently at 4%, and the income ceiling is set at ₱80,000.

For 2023, PhilHealth was supposed to implement a higher premium rate of 4.5% with a higher income ceiling rate of ₱90,000. However, President Ferdinand Marcos Jr. ordered to suspend the proposed contribution hike this year.[8]

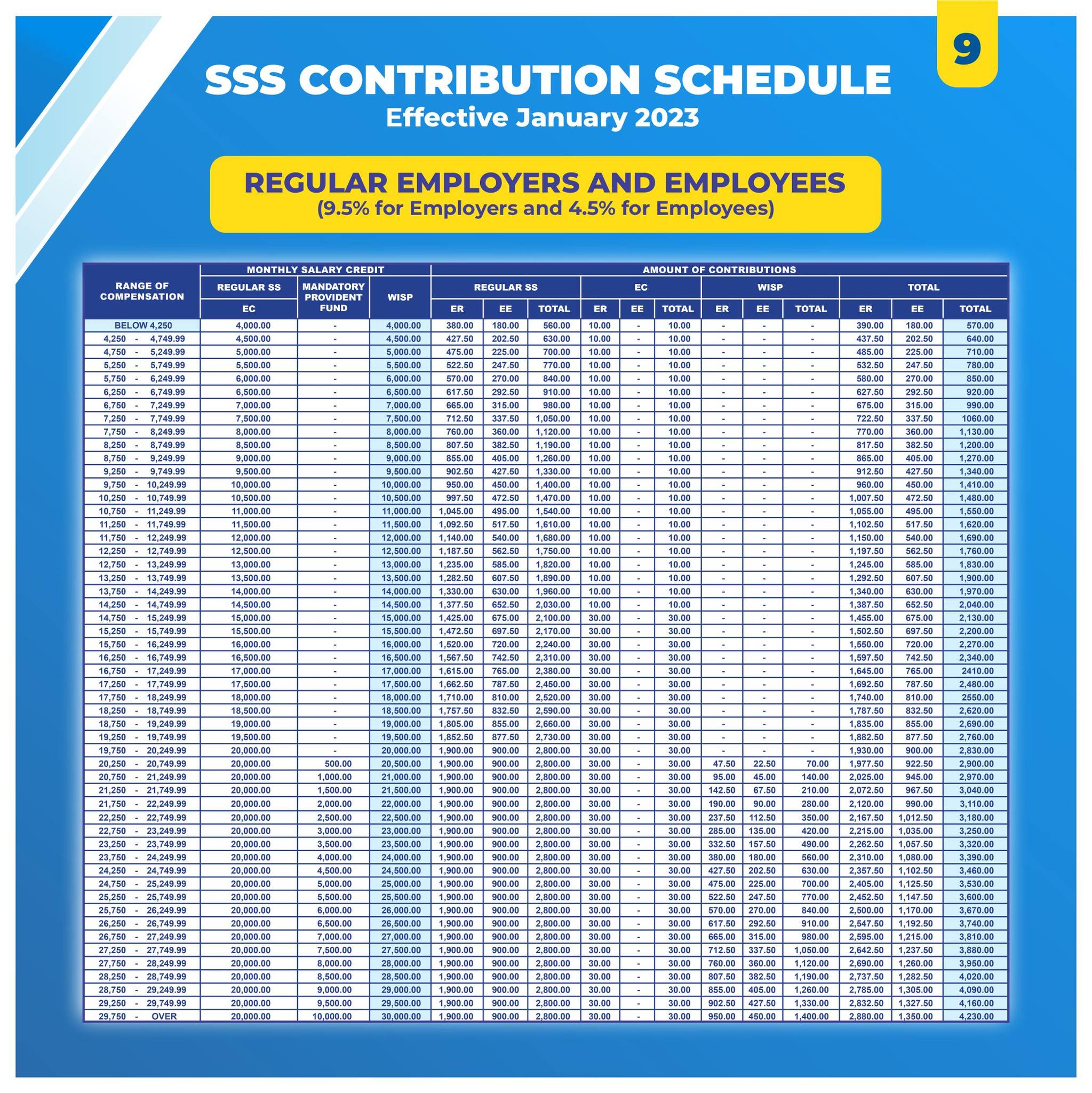

💸 SSS Contribution Table 2023

With the SSS contribution rate hike implemented in January 2023, the current SSS contribution rate is 14% of an employee's monthly salary credit, 9.5% of which is shouldered by the employer and 4.5% is deducted from the employee's salary.

Payment Due Dates That Employers Must Remember

To avoid penalties for late remittances, it's important to take note of the contribution payment due dates of each government agency.

📅 Pag-IBIG Contribution Payment Deadlines

Here are the Pag-IBIG Fund payment due dates (following the applicable month) according to the first letter of employer or business name:

- A to D: 10th to 14th day of the month

- E to L: 15th to 19th day of the month

- M to Q: 20th to 24th day of the month

- R to Z and 0 to 9: 25th to the last day of the month

📅 PhilHealth Contribution Payment Deadlines

Payment deadlines (following the applicable month) for PhilHealth are based on the last digit of the PhilHealth employer number:

- 0 to 4: 11th to 15th day of the month

- 5 to 9: 16th to 20th day of the month

📅 SSS Contribution Payment Deadlines

| Type of Payor | Deadline |

|---|---|

| Regular employers | Last day of the month following the applicable month |

| Household employers | Last day of the month following the applicable month or calendar quarter |

| Self-employed, Voluntary, and Non-Working Spouse Members | Last day of the month following the applicable month or calendar quarter |

| OFW members |

|

For SSS contribution payments, the deadline of payment of contributions for regular employers is on the last day of the month following the applicable month.

How to Pay Pag-IBIG, PhilHealth, and SSS Contributions

After deducting the monthly government contributions from your employees' salaries, remit them along with your employer share to Pag-IBIG, PhilHealth, and SSS branches or their authorized collecting partners such as banks and bills payment centers.

The easiest way is to use Bancnet's e-Gov, the centralized online facility for Pag-IBIG, PhilHealth, and SSS contribution filing and payments. It's also convenient because you can access its 24/7 service anytime.

The government agencies also require you to prepare and submit remittance reports that serve as proof of employer's monthly contribution payments.

Here are the contribution remittance forms you'll use when filing and paying government contributions:

- Pag-IBIG: Member's Contribution Remittance Form (MCRF)

- PhilHealth: Electronic Premium Remittance System (EPRS)

- SSS: Contribution Collection List (SSS Form R-3) and Employer Contributions Payment Return (SSS Form R-5)

Penalties for Violation of Rules on Government-Mandated Employee Benefits

Make sure to register, update employer and employee records, and pay contributions on time to avoid penalties. If employers fail or refuse to remit contributions deducted from employee salaries, their workers will still be entitled to government-mandated employee benefits. However, their loan applications with Pag-IBIG or SSS won't be approved.

Employees can check if employers are remitting their Pag-IBIG, PhilHealth, and SSS contributions. If they find out that their employers aren't paying, they can file a complaint, and the employer might be fined and jailed for violation of Philippine labor laws.

Below are the criminal penalties for failure to register, update records, or deduct and report government contributions:

- Pag-IBIG: A fine of not less than but not more than twice of the unpaid amount, six-year maximum imprisonment, or both

- PhilHealth: A fine of ₱5,000 to ₱10,000 multiplied by the total number of employees of the company

- SSS: A fine of ₱5,000 to ₱20,000, imprisonment of up to 12 years, or both

Meanwhile, here are the penalties for late remittance:

- Pag-IBIG: 1/10 of 1% of the amount due per day of delay

- PhilHealth: 2% of the amount due per month of delay

- SSS: 3% of the amount due per month of delay

Final Thoughts

Complying with government-mandated employee benefits in the Philippines is a serious business. If you take them for granted, it will cost you not just money but also your company's reputation. Thus, be sure to know and understand all the mandatory employee benefits you must provide as an employer.

Sources:

- [1] Labor Code of the Philippines

- [2] Cooperative Development Authority

- [3] PhilHealth Employer Data Record Form

- [4] Employer Registration (SSS Form R-1)

- [5] Employment Report (SSS Form R-1A)

- [6] Pag-IBIG Online Membership Registration

- [7] Pag-IBIG: No contribution hike in 2023, increase deferred to 2024 (GMA News Online, 2023)

- [8] No premium contribution increase in 2023: PhilHealth (Philippine News Agency, 2023)